Two months into 2025, the global stock market continues to show strength despite ongoing volatility and economic uncertainty. The S&P 500 index has risen by approximately 4%, while the MSCI World Index has gained around 5% as of February 20, 2025. This is an interesting trend, considering that the stock market has experienced strong growth over the past two years.

According to analysis, this increase is driven by central bank interest rate cuts, stable economic growth, and rising corporate earnings, despite pressures from trade tariffs and inflation. Additionally, three key trends have emerged in early 2025 that investors should pay attention to:

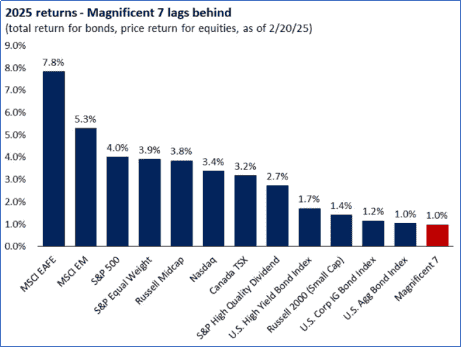

1. Mega-Cap Tech Stocks Lag Behind the Broader Market

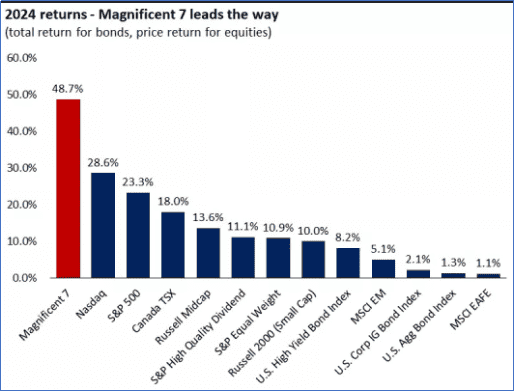

In 2024, large-cap technology stocks, particularly the “Magnificent 7” (Apple, Amazon, Google, Meta, Microsoft, Nvidia, and Tesla), dominated the market. These stocks significantly contributed to the S&P 500’s rise, primarily fueled by the surge in demand for artificial intelligence (AI). However, in early 2025, this group’s performance has started to lag behind other sectors.

Factors Behind the Weak Performance of Mega-Cap Tech Stocks:

- High Valuations: Large-cap tech stocks surged over 150% from 2023 to 2024, making their valuations expensive, though not to the extent of the 1999 tech bubble.

- Trade and Tariff Uncertainty: As global companies, they are more vulnerable to shifting trade policies, particularly in semiconductors and hardware.

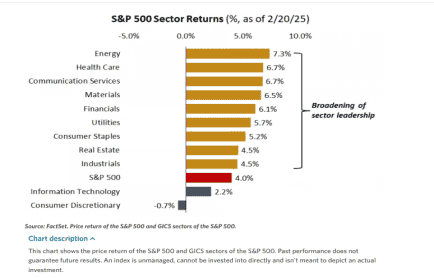

- More Balanced Earnings Growth Across Sectors: This year, earnings growth is no longer driven solely by the tech sector but also by finance, energy, and healthcare.

- Market Leadership Diversification: As of early 2025, 10 out of 11 sectors in the S&P 500 have posted positive growth, indicating that market leadership is expanding beyond technology and consumer sectors.

Conclusion: This trend suggests that market leadership is shifting to other sectors. Investors are advised to maintain a diversified portfolio, including both large- and mid-cap stocks from growth and value sectors.

2. U.S. Bond Yields Stabilize After a Sharp Surge

The 10-year Treasury yield surged by 120 basis points (1.2%) since September 2024, rising from around 3.6% to 4.8%. This increase was driven by a combination of factors:

- Stronger-than-expected U.S. economic data

- Inflation uncertainty

- Changes in new government spending policies

- Expectations that the Federal Reserve will not aggressively cut interest rates in 2025

However, in recent weeks, Treasury yields have stabilized around 4.5%.

Why Are Bond Yields Stabilizing?

- Controlled Inflation:

- Recent data shows that inflation, while still above the Federal Reserve’s 2% target, has significantly declined from its peak above 7%.

- The upcoming Personal Consumption Expenditures (PCE) report is expected to show inflation falling from 2.6% to 2.5%.

- Tighter Government Spending Policies:

- The new administration is focusing more on reducing expenditures and fiscal deficits, which could help maintain Treasury yield stability.

- Signs of Economic Slowdown:

- U.S. retail sales for January were lower than expected, and major companies like Walmart issued weaker financial forecasts.

- Potential new tariffs could impact consumer spending.

- If the economy or labor market slows down, the Federal Reserve may consider 1-2 rate cuts to support growth.

Conclusion: Bond yields are expected to remain within the 4% – 4.5% range throughout the year. This stability could support both the stock and bond markets while reducing uncertainty in the financial sector.

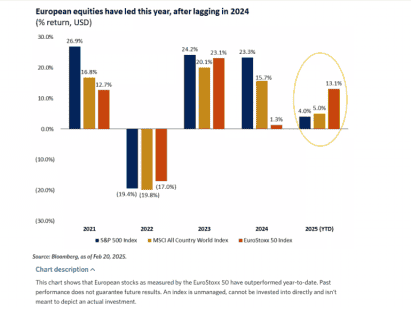

3. European Stocks Outperform the U.S. Market in Early 2025

One of the most notable trends in 2025 is the outperformance of European stocks compared to U.S. stocks. The EuroStoxx 50 has risen by approximately 13% since the beginning of the year, far surpassing the S&P 500 (+4%) and the MSCI World Index (+5%).

Factors Driving European Stock Gains:

- Weaker U.S. Dollar:

- A weaker dollar boosts the competitiveness of European companies in global markets and enhances investor sentiment toward international stocks.

- Positive Economic Data from the Eurozone:

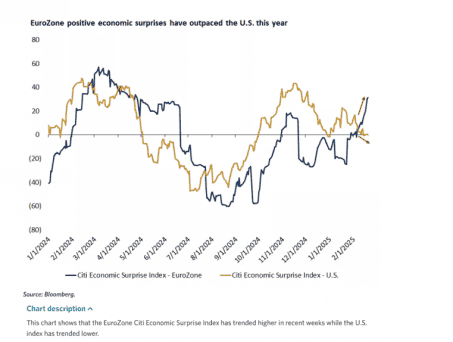

- The European economic surprise index has shown improvement compared to the U.S. in recent weeks.

- Hopes for a Resolution to the Russia-Ukraine War:

- Speculation that the war may end soon could bring stability and reduce energy prices in Europe.

- Elections in Major Countries:

- Elections in Germany and other nations could lead to increased fiscal spending, potentially supporting economic growth and the stock market.

Will This Trend Continue?

Although Europe currently has strong momentum, it is uncertain whether this performance will last throughout the year. Several risks to consider include:

- Whether the U.S. dollar’s weakness is temporary or sustained

- Whether positive sentiment regarding the Russia-Ukraine war materializes

- The long-term impact of fiscal policies on the market

Conclusion: While European stocks have seen strong gains, uncertainty remains regarding their sustainability. In the long run, U.S. stocks remain superior to European markets due to stronger economic growth and corporate innovation.