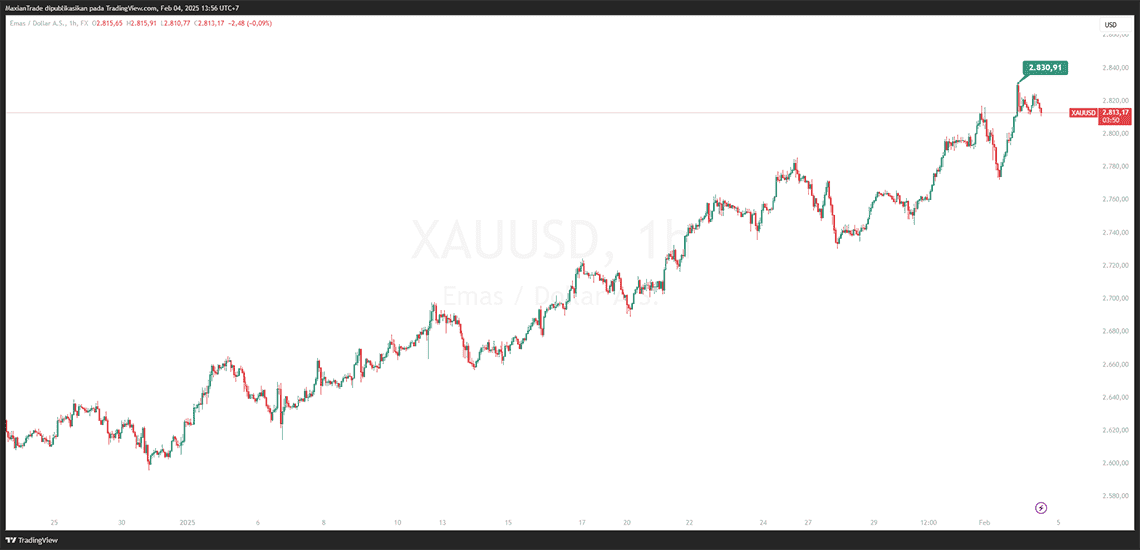

On Monday, February 3, 2025, gold prices surged to an all-time high of $2,830 per troy ounce. This price spike was triggered by former U.S. President Donald Trump’s decision to cancel import tariffs on Canada and Mexico, which had previously been imposed during his administration. This decision sparked mixed reactions in global markets, including a surge in demand for safe-haven assets such as gold.

Impact on Canada and Mexico

The tariff cancellation had a significant impact on the economies of Canada and Mexico. Some of the key implications of this policy change include:

1. Currency Appreciation

The Canadian dollar (CAD) and Mexican peso (MXN) experienced a significant appreciation against the U.S. dollar (USD) as investor confidence in the stability of trade among the three countries increased.

2. Boost in Exports

With the removal of trade barriers, the manufacturing and export sectors of Canada and Mexico received a major boost. Automotive, steel, and aluminum products, which previously faced high tax burdens, regained their competitiveness in the U.S. market.

3. Increase in Foreign Investment

Investors renewed their interest in the industrial sectors of both countries, particularly due to lower production costs compared to when the tariffs were in place. This is expected to drive economic growth in both nations over the long term.

Relation to Gold’s Price Surge

Gold, as a safe-haven asset, witnessed a sharp increase in demand following the announcement of this policy. Several key factors contributed to the rise in gold prices:

1. Inflation Concerns

With trade barriers removed, the prices of commodities and imported goods are expected to rise, potentially driving inflation in the U.S. This has led investors to hedge their positions by shifting to gold.

2. Weaker U.S. Dollar

Trump’s decision created uncertainty in the global currency markets, leading to a decline in the U.S. dollar index. A weaker dollar makes gold more attractive to international investors.

3. Speculation on Interest Rate Cuts

Markets began speculating that the Federal Reserve might consider adopting a more accommodative monetary policy to stabilize the U.S. economy, further fueling the rise in gold prices.

Gold Price Projections: Revisiting the $2,900 – $3,000 Levels

With gold prices reaching $2,830, analysts predict that the bullish trend could continue, especially if global economic uncertainty intensifies. Key factors to monitor moving forward include:

Trump’s Future Trade Policies

If Trump continues to take unpredictable policy actions, such as reinstating tariffs on other countries or introducing new regulations, gold market volatility could increase.

Federal Reserve Policy

Should the Fed decide to cut interest rates to counterbalance Trump’s policies, gold prices could break through the psychological level of $2,900 or even reach $3,000 in the coming months.

Global Geopolitical Situation

External factors such as geopolitical tensions, trade conflicts with other nations, or global economic uncertainty will play a crucial role in determining the future direction of gold prices.

Conclusion

Trump’s decision to cancel tariffs on Canada and Mexico has created new dynamics in global markets, bringing positive effects to both countries while also increasing volatility in the financial sector. The rise in gold prices to a record high of $2,830 indicates that investors are still seeking safe-haven assets amid uncertainty. If fundamental factors such as a weaker U.S. dollar and speculation on interest rate cuts persist, gold prices could continue their rally to even higher levels.