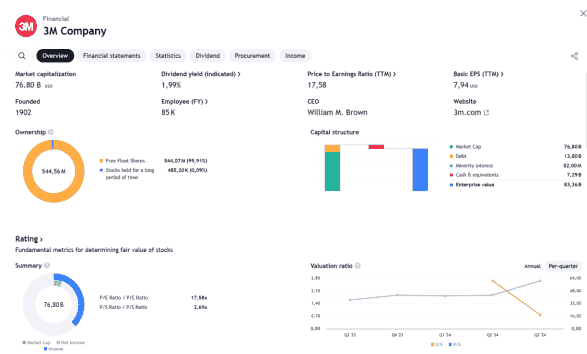

3M has strong market capitalization and a solid capital structure, with an enterprise value of $81.88 billion. Its moderate P/E ratio and a dividend yield of 1.99% make its stock appealing to investors seeking stability and dividend returns. However, the declining valuation trend may reflect market expectations of more moderate growth in the future.

- Share Ownership:

- Free float shares: 544.56 million.

- Long-term held shares: 458.25 thousand (a very small proportion).

- Capital Structure:

- Market Capitalization: $76.8 billion.

- Debt: $13.6 billion.

- Cash and Equivalents: $7.28 billion.

- Enterprise Value: $81.88 billion.

- Financial Performance:

- Price to Earnings (P/E) Ratio: 17.58x, indicating a relatively reasonable stock valuation compared to net earnings.

- Price to Sales (P/S) Ratio: 2.48x, reflecting a relatively low valuation compared to revenue per share.

- Basic EPS (Earnings Per Share): $7.94 (trailing 12 months).

- Dividend Yield:

- Dividend Yield: 1.99%, indicating a stable return of dividends to shareholders.

- Valuation Trends:

- The chart shows a slight downward trend in annual and quarterly valuation ratios from Q3 2023 to Q1 2024, with some stability at certain points.