Reviews

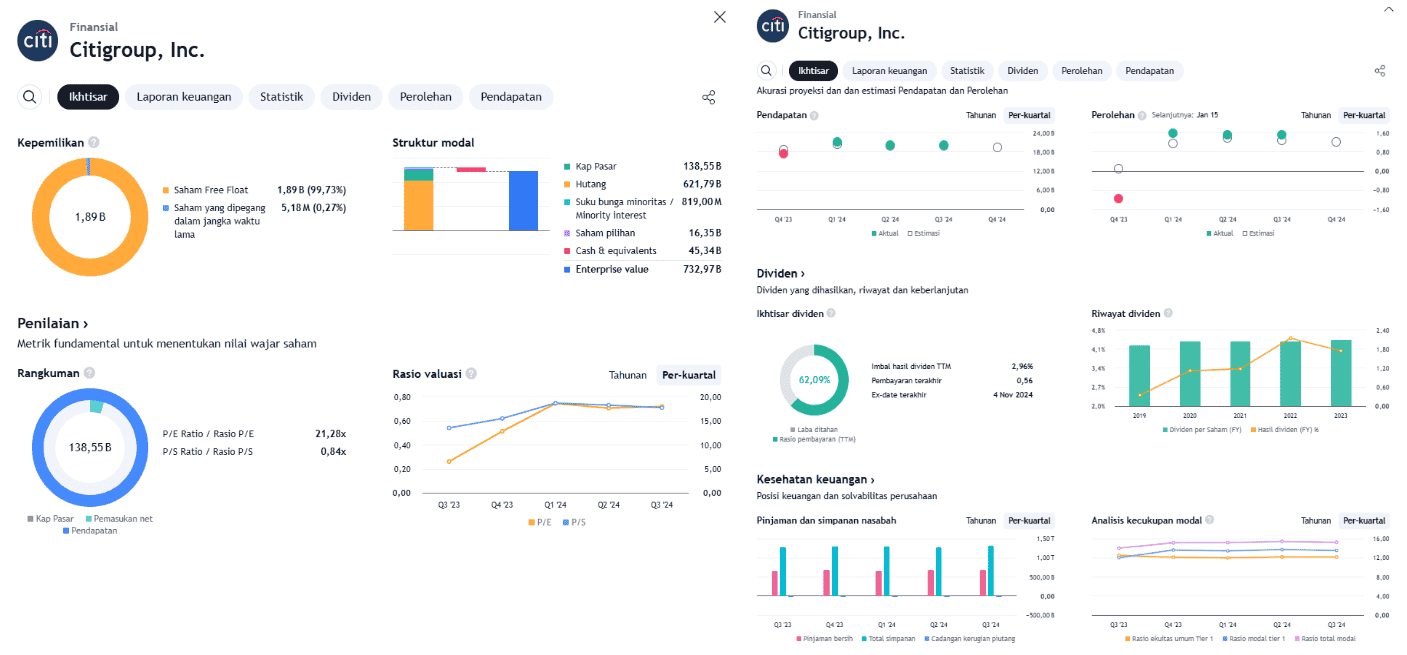

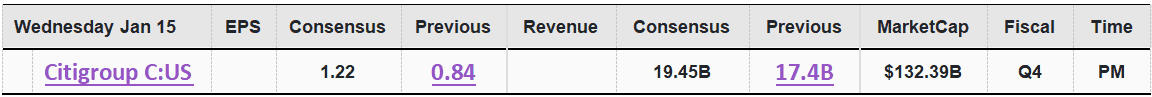

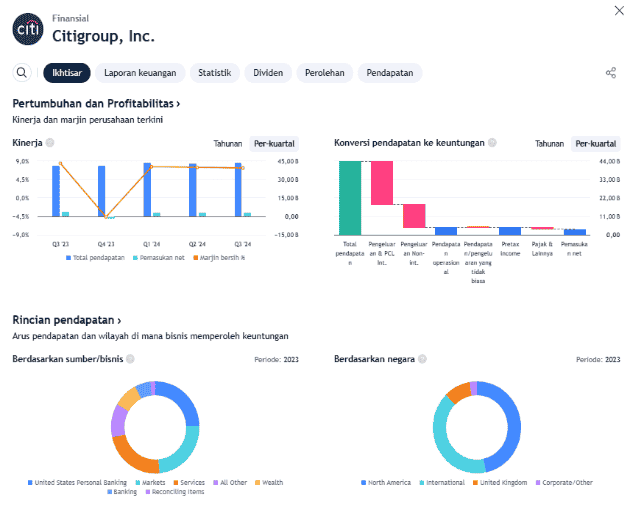

Keefe, Bruyette & Woods (KBW) maintained “Outperform” recommendation for Citigroup (NYSE: C) shares with a price target of $71.00. They project profit for Citigroup from possibility revision more stringent Basel III rules loose, which can increase bank’s earnings per share (EPS) by 18%. Citigroup also showed performance solid financial with projection 2024 revenue to reach $80–81 billion and share buyback plans worth $1 billion.

Citigroup continues get support positive from analysts, with target prices share between $85–$110. In addition, the company extend partnership with American Airlines for AAdvantage® co-brand card for 10 years, strengthening growth and loyalty strategy customer.