On January 29, 2025, the Federal Open Market Committee (FOMC) announced its decision to maintain the benchmark interest rate within the 4.25%–4.50% range. This decision followed three consecutive rate cuts in 2024, which lowered the rate by a full percentage point. Federal Reserve Chairman Jerome Powell stated that while inflation remains high, it is on track toward the 2% target, and unemployment remains stable. As a result, the Fed decided to take a cautious approach in adjusting its monetary policy.

Impact on Financial Instruments

- Gold (XAUUSD) Potential Rise to 2800.00

Gold prices saw a slight increase after the Fed’s announcement. On January 30, 2025, spot gold was at $2,760.23 per troy ounce, up 0.03% from the previous close. The Fed’s decision to hold rates provided insight into possible future borrowing cost reductions, supporting gold’s climb toward 2800.00. - Nasdaq Index Potential Strengthening to 22,000

The stock market, including the Nasdaq index, responded positively to the Fed’s decision. Asian markets, which often follow Wall Street movements, are expected to strengthen after previous sell-offs. Investors welcomed the Fed’s rate hold, signaling confidence in economic stability and the growth outlook for tech companies dominating Nasdaq. - US Dollar Index (DXY) Potential Pullback to 107.000 – 106.500

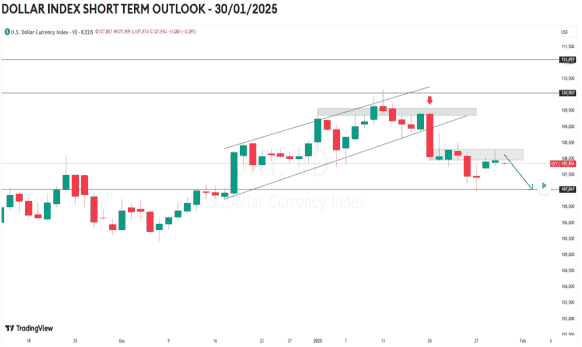

The US Dollar Index saw minimal gains after the Fed’s announcement. The decision to maintain interest rates, coupled with Powell’s statement on US economic strength and inflation moving toward target levels, provided support for the dollar. Additionally, global uncertainties and the US’s aggressive trade policies fueled demand for the dollar as a safe-haven asset. However, a potential profit-taking action could drive the Dollar Index lower, especially as technical resistance at 108.000 remains unbroken.

Potential Dollar Index Movement Post-FOMC Meeting

The Dollar Index is expected to continue weakening towards the 107.000 – 106.500 level following the FOMC Meeting, which leaned towards a “Dovish Hold.” The Fed emphasized a data-dependent approach to future monetary policy, leading to bearish pressure on the Dollar Index.

📌 Source: TradingView Chart

📌 Disclaimer On

Conclusion

The FOMC decision on January 29, 2025, to maintain interest rates reflects confidence in U.S. economic strength and inflation trends. The impact is evident across financial instruments: gold prices saw slight gains, the Nasdaq index strengthened, and the U.S. Dollar Index showed signs of weakening. Investors are advised to closely monitor the Fed’s monetary policy and key economic indicators to make informed investment decisions.