JPMorgan is scheduled to release its first-quarter (Q1) 2025 earnings report on April 11. As the largest bank in the United States, JPMorgan’s financial results are closely watched as they serve as a benchmark for the overall performance of the banking sector. In the previous quarter, JPMorgan delivered solid results, driven by strong performance in investment banking and trading. However, for Q1 2025, its performance is expected to be more moderate.

Zacks’ consensus estimate for revenue this quarter stands at $43.01 billion, reflecting a 2.6% increase year-over-year. However, earnings per share (EPS) are projected to decline by nearly 1%, primarily due to higher credit loss provisions, increased operating expenses, and weaker capital markets performance.

Key Factors Influencing JPMorgan’s Q1 2025 Performance

1. Net Interest Income (NII)

Although the Federal Reserve kept interest rates unchanged in the 4.25%–4.5% range during the first quarter, this is expected to provide modest support to JPMorgan’s NII, thanks to stable funding and deposit costs. Demand for commercial and industrial loans, real estate financing, and consumer lending remained moderate in the early part of the quarter.

- Zacks’ estimate for NII: $23.2 billion

- Expected to grow by 1% to: $23.31 billion

2. Investment Banking Fees

Global merger and acquisition (M&A) activity in Q1 2025 was less impressive than expected. Although deal value and volume showed slight increases, most of the growth was concentrated in the Asia-Pacific region. Uncertainty surrounding tariff policies under the Trump administration led to significant market volatility, causing major corporations to delay their M&A plans. Nevertheless, JPMorgan’s strong leadership in the sector is expected to support modest growth in advisory fees.

- Estimated investment banking (IB) revenue: $2.53 billion (up 13% YoY)

- Zacks’ estimate for IB revenue in the Corporate & Investment Banking segment: $2.61 billion

- IPO and bond issuance activities remained relatively weak

3. Markets Revenues

High market volatility, especially related to tariffs and economic uncertainty, kept client trading activity stable.

- Equity markets revenue estimate: $3.01 billion (up 16.5% YoY)

- Fixed-income markets revenue estimate: $5.99 billion (up 10.4% YoY)

- Market revenue is expected to grow steadily, driven by heightened volatility

4. Mortgage Banking Fees

Despite interest rate cuts by the central bank in 2024, mortgage rates remained elevated around 6.5% in Q1 2025. Nevertheless, refinancing activity and mortgage origination volumes remained healthy.

- Zacks’ mortgage banking fees estimate: $355.7 million (up 29.3% YoY)

- Internal estimate: $398.6 million

5. Expenses

JPMorgan’s expansion plans—including opening new branches and entering new markets—are expected to increase operating expenses. Additionally, investments in digital technology and infrastructure are contributing to higher costs.

- Estimated non-interest expense: $23.8 billion (up 4.5% YoY)

6. Asset Quality

JPMorgan is likely to allocate a significant amount to loan loss reserves, particularly for commercial loans, given expectations for higher interest rates and the inflationary impact of imposed tariffs.

- Estimated credit loss provisions: $2.45 billion

- Estimated non-performing loans (NPLs): $9.32 billion (up 21.5% YoY)

Earnings Outlook and Upside Potential

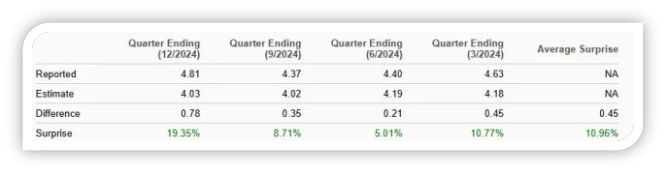

Based on Zacks’ model, JPMorgan has a strong likelihood of beating earnings expectations this quarter. This is due to a combination of a positive Earnings ESP (+0.88%) and a Zacks Rank of #1 (Strong Buy) or #2 (Buy).

Earnings Surprise History & Stock Valuation

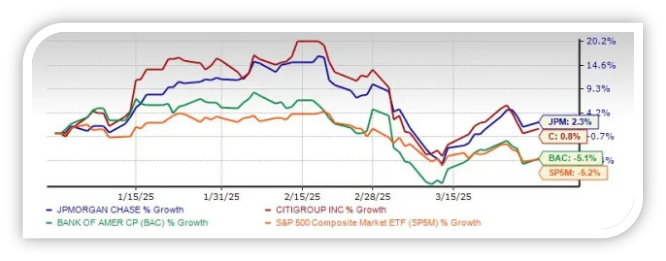

JPMorgan’s stock performed well in the first quarter of 2025, outperforming the S&P 500 index as well as its closest rivals—Bank of America and Citigroup. However, JPMorgan’s shares are currently trading at a price-to-earnings (P/E) ratio of 12.40x, which is higher than the industry average of 11.66x, and also higher than:

- Citigroup: P/E 7.93x

- Bank of America: P/E 9.66x

Should You Buy, Hold, or Sell JPMorgan Stock Before the Q1 Earnings Release?

JPMorgan is well-positioned to benefit from its scale and dominant presence across various banking sectors. The acquisition of First Republic Bank in 2023 continues to support its financial strength. Although the company’s expansion strategy may lead to higher capital expenditures, it presents promising long-term prospects and provides JPMorgan with a competitive advantage.

However, ongoing capital market volatility could limit fee-based revenue growth. The stock’s premium valuation is also a factor worth considering. Therefore, investors are advised to closely monitor management’s commentary on Net Interest Income and investment banking outlook during the Q1 2025 earnings call before making investment decisions. Furthermore, macroeconomic factors should be taken into account, as they may significantly influence the company’s future performance.