Maxco.co.id – The commodity market offers various profit opportunities, and one of the most attractive commodities for traders is XAUUSD (Gold/USD), or gold against the US dollar. Many traders are racing to find opportunities in this commodity using the best XAUUSD trading techniques and strategies they have.

Gold, as a safe-haven asset, has unique price movements and is influenced by various factors, from geopolitics and inflation to market sentiment.

To succeed in XAUUSD trading, a tested trading strategy and an in-depth understanding of market dynamics are essential. This article will discuss an XAUUSD trading strategy that utilizes a combination of simple yet effective technical indicators: the Exponential Moving Average (EMA) and the Stochastic Oscillator.

Understanding XAUUSD: Factors Affecting Its Price

Before discussing the trading strategy, it’s important to understand the factors influencing XAUUSD prices. This can be considered a touch of fundamental analysis that you should know to support the technical analysis discussed in this article.

Gold prices are very sensitive to:

- US Dollar

The relationship between gold and the US dollar is generally inverse, meaning they move in opposite directions. When the US dollar strengthens, gold prices tend to weaken, and vice versa. For example, an interest rate hike in the US usually increases the dollar’s value and puts pressure on gold prices.

- Inflation

Gold is often seen as a hedge against inflation, commonly referred to as a “safe haven.” When inflation rises, investors tend to turn to gold as a safer asset to protect their wealth, increasing demand and raising gold prices.

- Geopolitics

Geopolitical uncertainties, such as wars or political crises, can drive investors to seek safety in gold, causing its price to rise.

- Market Sentiment

Overall market sentiment also plays an important role. If the market is optimistic, investors may lean towards higher-risk assets like stocks, causing gold prices to drop. Conversely, negative sentiment can boost gold demand and increase its price.

- Industrial Demand

Demand for gold from the jewelry and technology sectors also affects its price. An increase in demand from these sectors will drive gold prices higher.

XAUUSD Trading Strategy with EMA and Stochastic Oscillator

This strategy combines two technical indicators that are easy to understand and interpret: the Exponential Moving Average (EMA) and the Stochastic Oscillator.

EMA gives an overview of the trend, while the Stochastic Oscillator helps identify overbought and oversold conditions.

1. Exponential Moving Average (EMA): Identifying Trends

EMA is an exponential moving average that gives more weight to recent price data. We will use two EMAs:

- Fast EMA: Use an EMA with a 12-period setting.

- Slow EMA: Use an EMA with a 26-period setting.

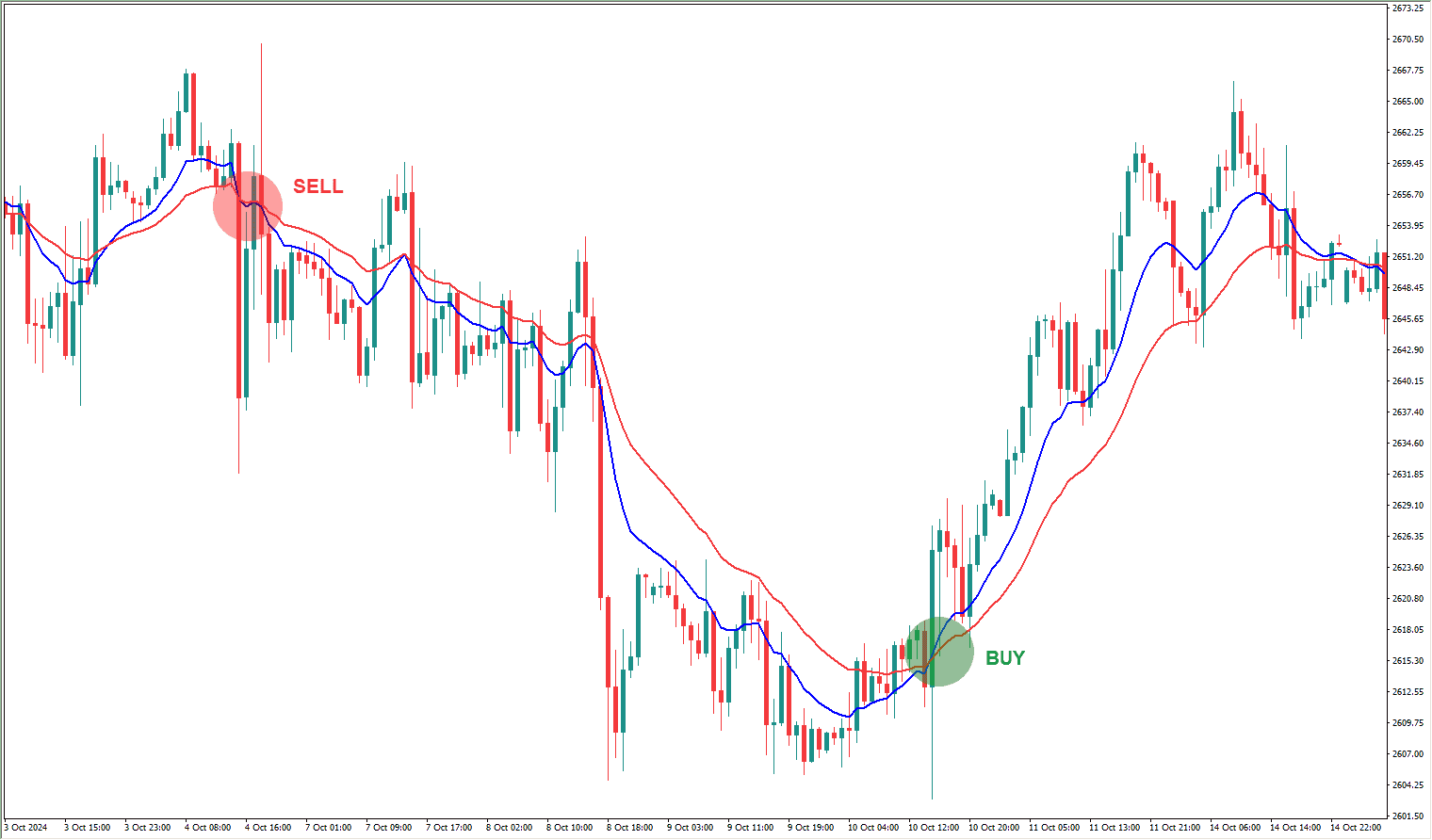

The crossover between the fast and slow EMA will serve as a signal to open a trading position. When the fast EMA crosses the slow EMA from below, it’s a buy signal. Conversely, when the fast EMA crosses from above, it’s a sell signal.

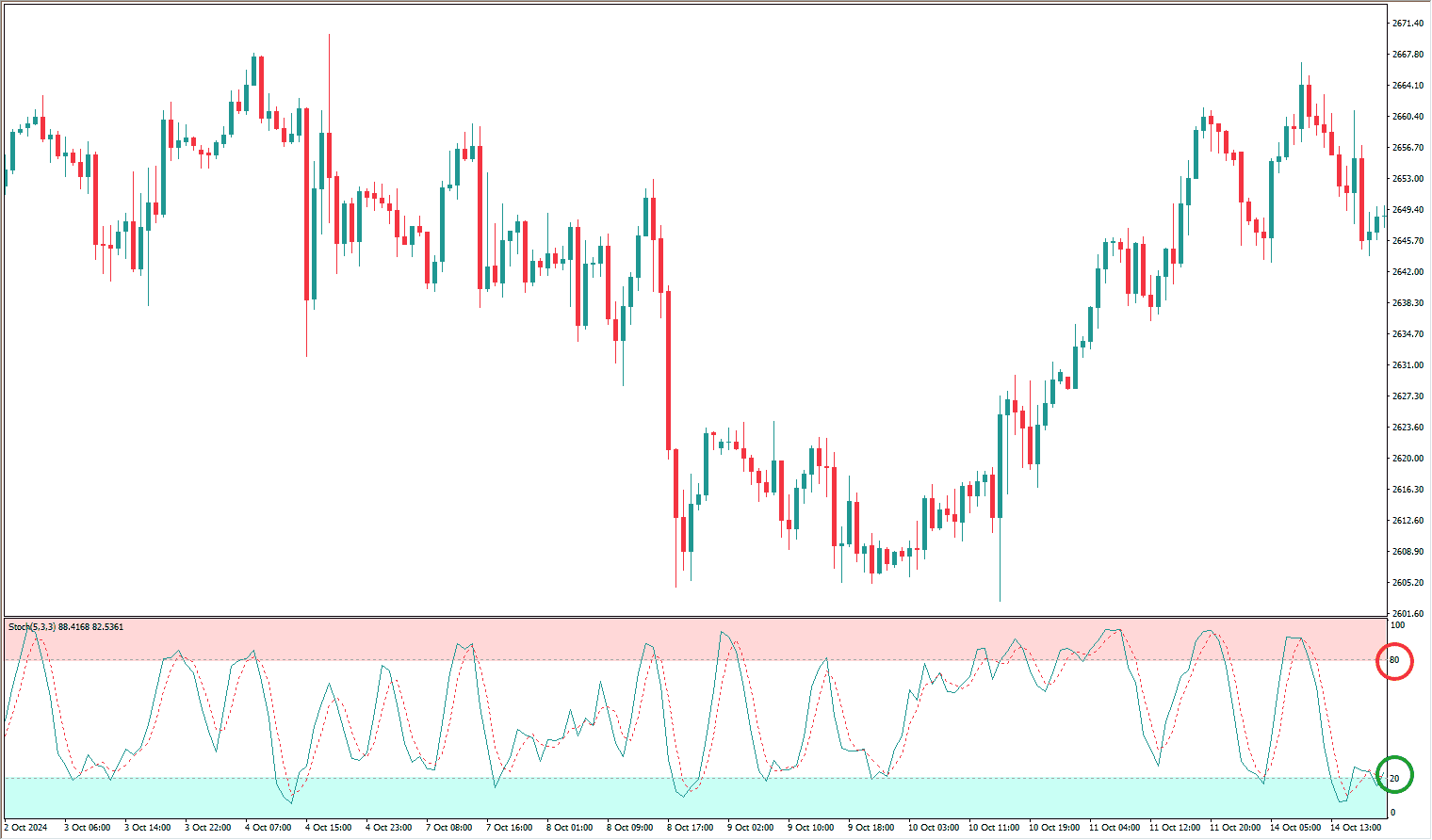

2. Stochastic Oscillator: Identifying Overbought and Oversold Conditions

The Stochastic Oscillator is a momentum oscillator that measures the speed and change of price relative to previous price ranges. The Stochastic Oscillator values range between 0 and 100.

- Overbought Condition:

When the Stochastic Oscillator value is above 80, it indicates that the price may be considered too high for the moment, suggesting a potential correction or decline. - Oversold Condition:

When the Stochastic Oscillator value is below 20, it indicates that the price may be low enough to suggest a potential rebound or increase.

The image below shows the Stochastic Oscillator indicator with overbought (pink) and oversold (light green) areas.

Combining EMA and Stochastic Oscillator for XAUUSD Trading Strategy

This strategy combines signals from the EMA and the Stochastic Oscillator to increase accuracy and reduce risk.

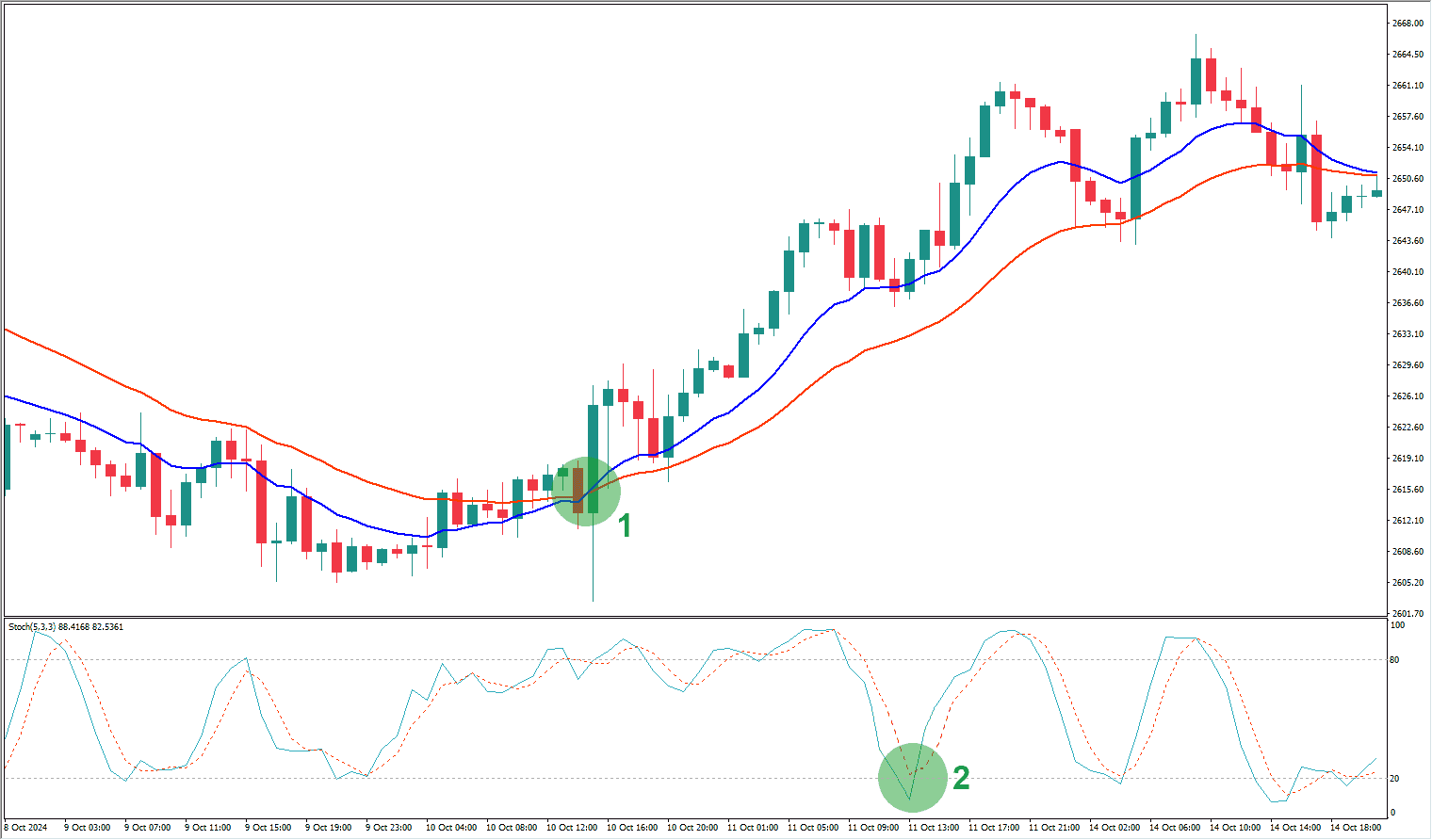

- Buy Signal

Open a long position when:- The 12 EMA crosses the 26 EMA from below.

- Wait for the Stochastic Oscillator to be in the oversold area (around 20) and then cross upward. This confirms a potential price rebound.

On the chart, the steps will look like this:

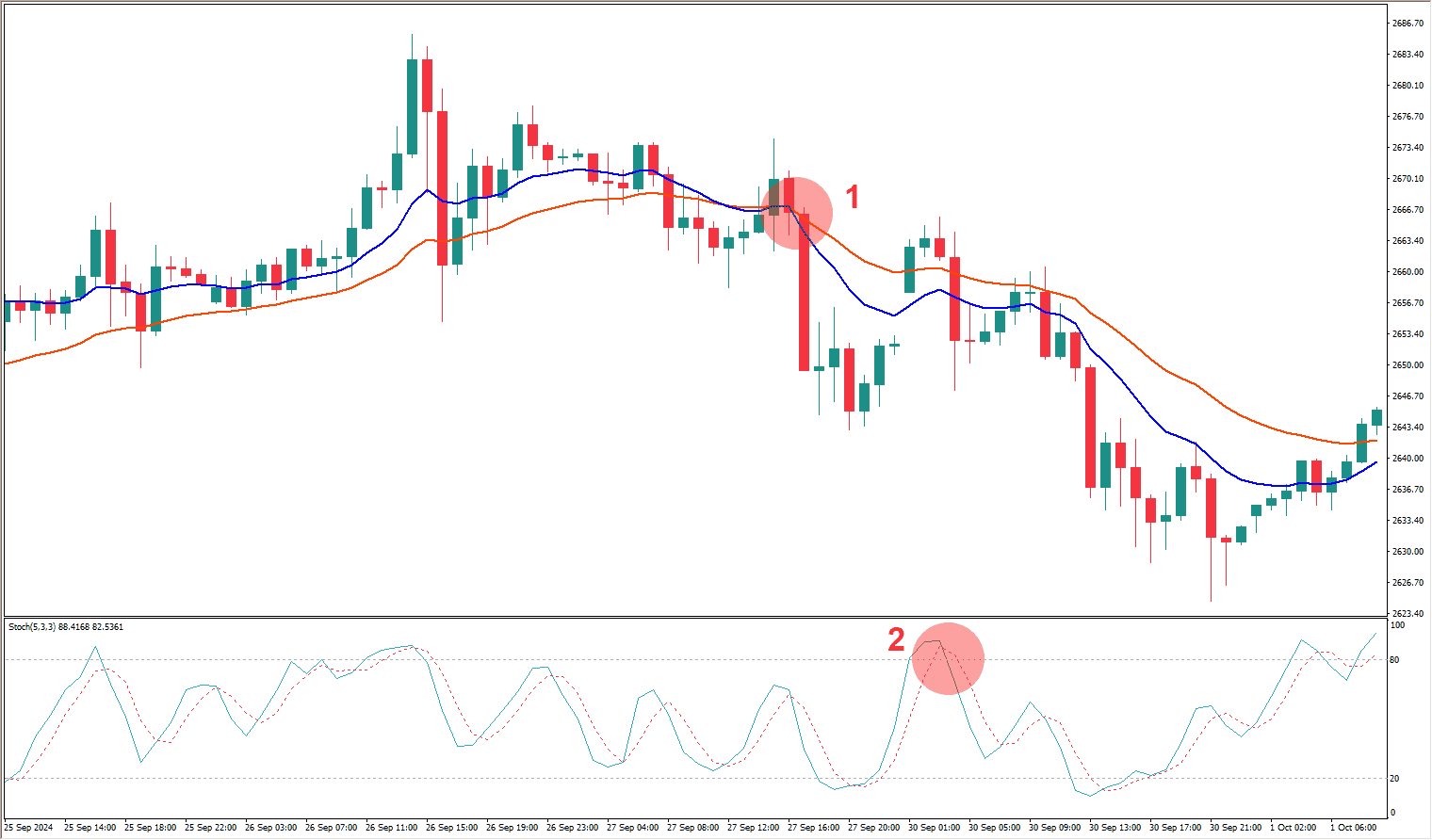

- Sell Signal

Open a short position when:- The 12 EMA crosses the 26 EMA from above.

- The Stochastic Oscillator is in the overbought area (above 80) and then crosses downward. This suggests the price may be ready for a correction.

On the chart, the sell setup will appear as follows:

Don’t Forget Risk Management

No matter how good your trading strategy is, risk management remains crucial. Here are some risk management tips to consider:

- Use Stop Loss: Always use a stop loss order to limit potential losses. A stop loss will automatically close your position if the price moves against you.

- Use Take Profit: Set your profit target before opening a position. A take profit order will automatically close your position when the price reaches the set profit target.

- Avoid Overtrading: Avoid excessive trading. Overtrading can lead to emotional decisions and increase the risk of loss.

- Backtesting: Before applying this strategy to a live trading account, perform backtesting to test its effectiveness on historical data.

Summary

The XAUUSD trading strategy with a combination of EMA and Stochastic Oscillator is a simple yet effective approach for seeking profit opportunities in the gold market. However, it’s important to remember that the forex market is always full of risks, and no strategy guarantees 100% profit.

Discipline, good risk management, and in-depth market knowledge are the keys to success in trading. Always do your research and keep learning to enhance your trading skills. Hopefully, this article will be useful and help you on your XAUUSD trading journey. Remember to keep practicing and refining your analytical skills before entering the real market.