Gold Trading (Gold or XAUUSD) is one of the favorite instruments for traders, both in Indonesia and internationally. However, we need to understand what actually drives traders’ interest and the growing popularity of Gold trading.

There are several supporting factors that make Gold trading one of the most preferred instruments:

1. Understanding Gold Price Movements is Relatively Easy

Gold price movements tend to be stable and show a pattern of strengthening or rising, making them easier to analyze.

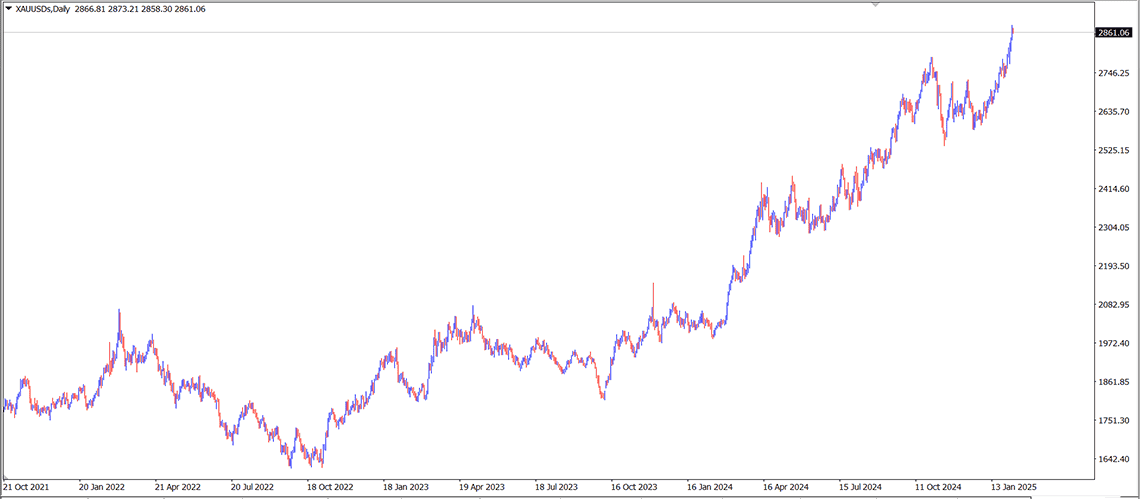

Gold (XAUUSD) Daily Movement Chart

From this chart, we can clearly observe that gold prices tend to increase over time. This means that placing BUY transactions is often considered the most profitable position in Gold trading.

2. Wide Average Daily Price Movements

Gold has an average daily movement range of around $15 to $30, meaning there is a potential profit of $1,500 to $3,000 per transaction for every lot traded.

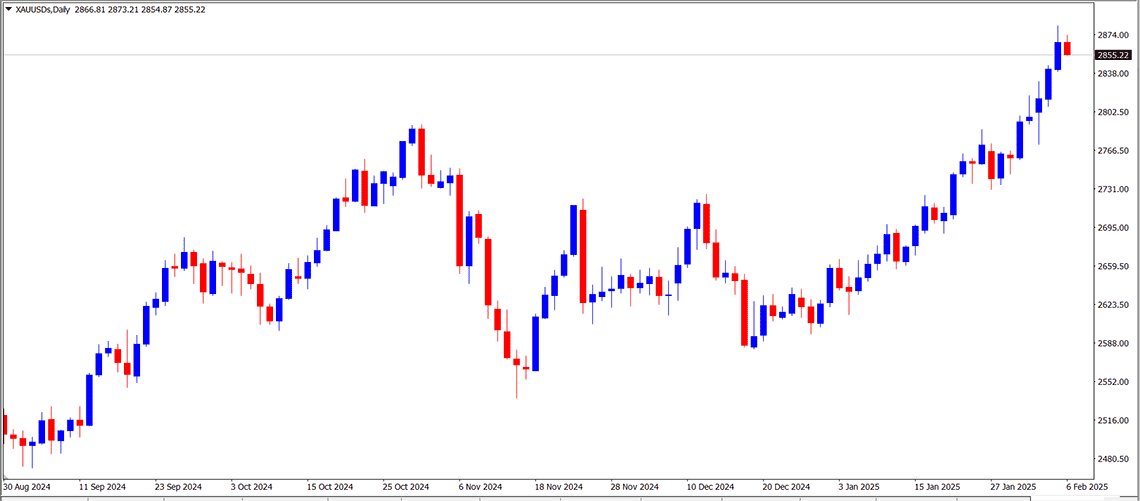

Gold (XAUUSD) Daily Movement Chart

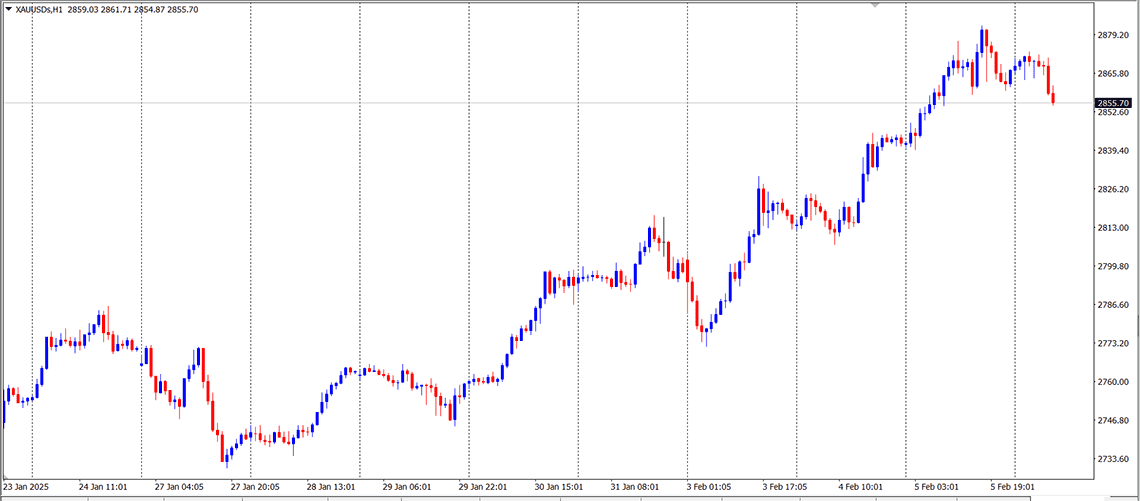

Gold (XAUUSD) Daily Range Movement in H1 Chart

This is one of the key factors that attract traders. However, it is important to note that gold price movements do not follow a stepped or exponential increase but rather fluctuate in both directions—upward and downward.

Another important factor that attracts traders is trading capital requirements.

3. Trading Capital for Gold (XAUUSD) Transactions

The required capital to trade Gold (XAUUSD) is $1,000 per lot (if using 1:100 leverage) or $200 per lot (if using 1:500 leverage). This means that any investor or trader who wants to take advantage of price movements only needs a margin of $1,000 or $200.**

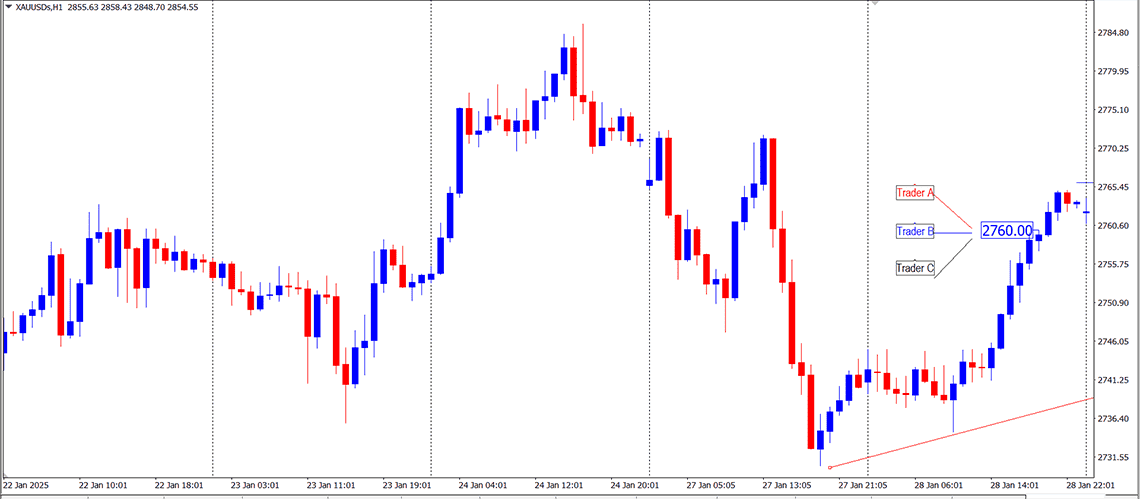

Illustration of Investment Value and Fund Management in Price Movements

Let’s look at an illustration of three Traders or Investors:

INVESTORS

a. Investor A

- Investment: $10,000

- Leverage: 1:100

- Transaction: 1 Lot

b. Investor B

- Investment: $50,000

- Leverage: 1:100

- Transaction: 1 Lot

c. Investor C

- Investment: $5,000

- Leverage: 1:100

- Transaction: 1 Lot

If these investors agree to place a BUY position on XAU at the price of 2760 with 1 Lot using the same leverage of 1:100 (which means a transaction margin of $1,000 per lot).

Berikut adalah terjemahan dalam bahasa Inggris dari teks dalam gambar:

So, we will see the difference in the investor’s condition:

Investor A – BUY XAUUSD 1 LOT at a price of 2760 (Investment Capital: $10,000)

| Balance (Saldo) | $10,000 |

|---|---|

| Equity | $10,000 |

| Floating | $0 |

| Free Margin | $9,000 |

| Margin Level | 1,000% |

| Margin | $1,000 |

When the Price Increases to 2766

| Balance (Saldo) | $10,000 |

|---|---|

| Equity | $10,600 |

| Floating | $600 |

| Free Margin | $9,600 |

| Margin Level | 1,060% |

| Margin | $1,000 |

When the Price Drops to 2756

| Balance (Saldo) | $10,000 |

|---|---|

| Equity | $9,000 |

| Floating | -$1,000 |

| Free Margin | $8,000 |

| Margin Level | 1,060% |

| Margin | $1,000 |

When the Price Drops to 2745

| Balance (Saldo) | $10,000 |

|---|---|

| Equity | $9,000 |

| Floating | -$2,100 |

| Free Margin | $7,900 |

| Margin Level | 790% |

| Margin | $1,000 |

This shows how price fluctuations affect the investor’s equity and margin.

Berikut terjemahan dari teks pada gambar:

Investor B – BUY XAUUSD 1 LOT at price 2760 (Investment Fund of $50,000)

| Balance (Saldo) | $50,000 |

|---|---|

| Equity (Equitas) | $50,000 |

| Floating | $0 |

| Free Margin | $49,000 |

| Margin Level | 5,000% |

| Margin | $1,000 |

When the Price Increases to 2766

| Balance (Saldo) | $50,000 |

|---|---|

| Equity (Equitas) | $50,600 |

| Floating | $600 |

| Free Margin | $49,600 |

| Margin Level | 5060% |

| Margin | $1,000 |

When the Price Drops to 2756

| Balance (Saldo) | $50,000 |

|---|---|

| Equity (Equitas) | $49,000 |

| Floating | -$1,000 |

| Free Margin | $48,000 |

| Margin Level | 4900% |

| Margin | $1,000 |

When the Price Drops to 2745

| Balance (Saldo) | $50,000 |

|---|---|

| Equity (Equitas) | $47,900 |

| Floating | -$2,100 |

| Free Margin | $46,900 |

| Margin Level | 4790% |

| Margin | $1,000 |

Investor C – BUY XAUUSD 1 LOT at a price of 2760 (Investment Fund of $50,000)

Initial Condition

| Balance (Saldo) | $5,000 |

|---|---|

| Equity (Ekuitas) | $5,000 |

| Floating | $0 |

| Free Margin | $4,000 |

| Margin Level | 5.00% |

| Margin | $1,000 |

When the Price Increases to 2766

| Balance (Saldo) | $5,000 |

|---|---|

| Equity (Ekuitas) | $5,600 |

| Floating | $600 |

| Free Margin | $4,600 |

| Margin Level | 560% |

| Margin | $1,000 |

When the Price Drops to 2756

| Balance (Saldo) | $5,000 |

|---|---|

| Equity (Ekuitas) | $4,000 |

| Floating | -$1,000 |

| Free Margin | $4,000 |

| Margin Level | 400% |

| Margin | $1,000 |

When the Price Drops to 2745

| Balance (Saldo) | $5,000 |

|---|---|

| Equity (Ekuitas) | $2,900 |

| Floating | -$2,100 |

| Free Margin | $2,900 |

| Margin Level | 290% |

| Margin | $1,000 |

From the three illustrations above, we can conclude several key points:

- One of the most important factors is the amount of funds managed in the trading account (Margin).

- Price movements do not follow an exponential or linear function but fluctuate within a trend, whether it is an uptrend or a downtrend.

- Every fluctuation will impact the value of equity.

- As long as a trade position remains open, the value will continue to change automatically based on the latest market price, which can be seen in the “Account Status.”

- Changes in equity can also be influenced by other costs associated with the transaction.

- The lot size used significantly affects equity movements, so it is essential to use an optimal lot size in every transaction.

- If the daily price fluctuation ranges between $15 and $30, then each fluctuation may result in a movement of approximately $1,500 to $3,000 per lot.

For a more structured and measured trading approach, investors must understand the behavior and movement patterns of the instruments they trade.

However, due to the nature of gold price movements, which tend to increase—where XAUUSD is considered a hedge against inflation—analysts agree that gold follows a long-term upward trend.

You also need to understand your own trading style—whether you prefer trading based on the main trend, corrective movements, or both. This is because XAUUSD price fluctuations are highly influenced by perception, demand, supply, and economic news, which generate either bullish or bearish sentiment.