Gold prices reached a new all-time high of $2,940.00 on Monday, February 10, 2025, as market concerns over the Trump Tariff policy escalated, potentially triggering global trade tensions. This sentiment has driven investors toward safe-haven assets like gold, which has now recorded six consecutive weeks of gains—its longest rally since 2020.

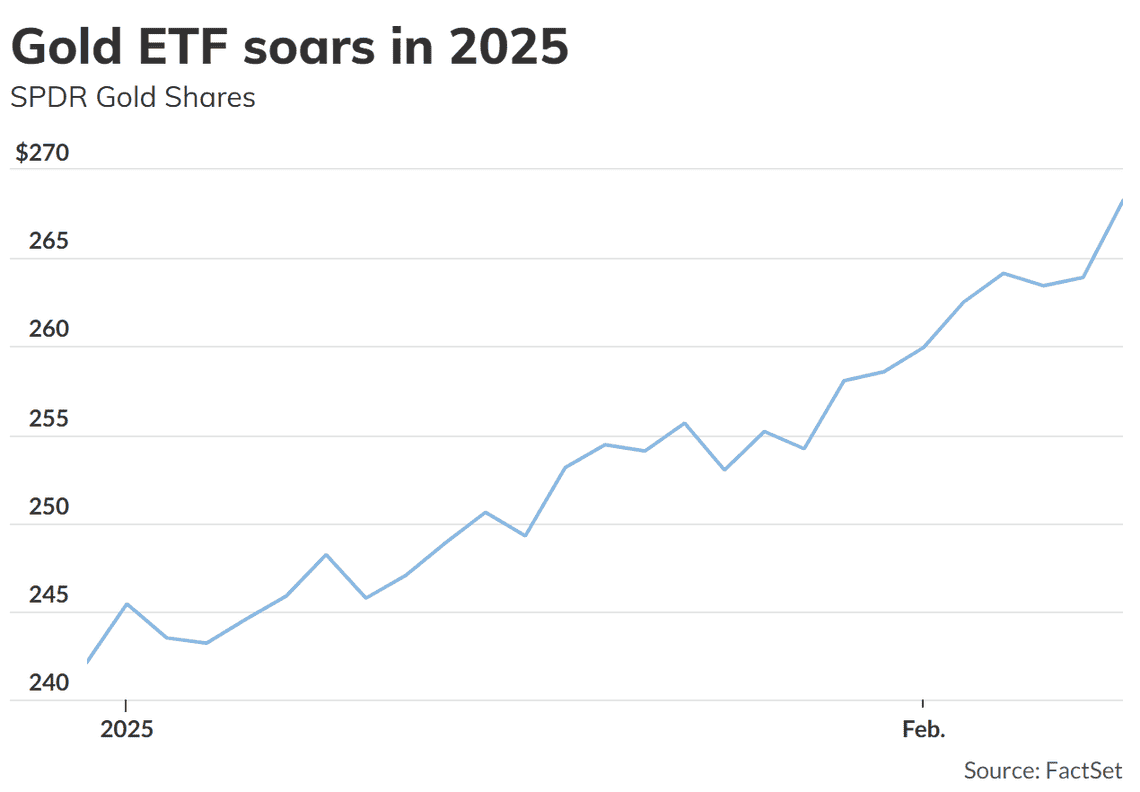

This surge in gold prices has also increased demand for gold-backed Exchange-Traded Funds (ETFs), particularly SPDR Gold Shares (GLD), which jumped 1.7% in a single trading day, reflecting investor optimism for further gold rallies in the near future.

Technically, gold is now on track to reach the psychological level of $3,000, which could be achieved soon if global risk sentiment continues to support demand for safe-haven assets. With the bullish trend still strong, many analysts predict that gold prices could extend their rally, especially if economic and geopolitical uncertainty intensifies.

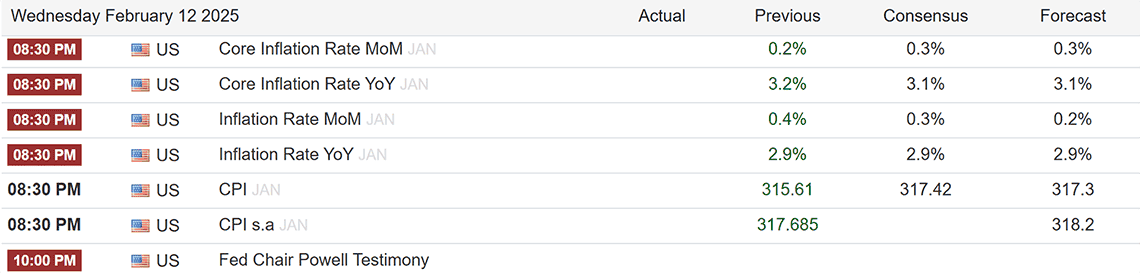

Meanwhile, the US Dollar Index (DXY) remains stable around 108.000 ahead of the US inflation data (CPI) release on Wednesday. The dollar is expected to weaken to 107.000 due to falling energy prices, keeping inflation stagnant at 2.9%.

The market is closely watching this inflation data, which could influence Federal Reserve monetary policy and the movement of both gold and the dollar.

With a combination of supporting fundamental and technical factors, gold’s movement in the coming days will depend on market reactions to US tariff policies and key economic data. If US inflation rises significantly, volatility in gold and the dollar could increase, potentially accelerating gold’s push toward $3,000.