Maxco.co.id – The world of forex trading offers attractive profit potential but is also filled with risks. Success in forex largely depends on accurate and proven trading strategies.

Many novice traders are tempted by promises of quick profits, but in reality, consistent profitability requires a deep understanding of the market, risk management, and solid trading strategies.

This article will discuss various profitable forex trading strategies designed specifically for beginner traders, written in the simplest terms for easy understanding.

Before you continue reading, remember that no strategy guarantees 100% profit. However, with proper understanding and discipline, you can increase your chances of success.

Understanding the Basics Before Choosing a Forex Trading Strategy

Before diving into specific strategies, it’s essential to understand some fundamental forex trading concepts:

- Currency Pairs

The forex market is a currency exchange market. You will conduct transactions involving several currency pairs, such as EUR/USD (Euro against the US Dollar), GBP/USD (Pound Sterling against the US Dollar), USD/JPY (US Dollar against the Japanese Yen), and others.

Currency values fluctuate based on the strength of one currency compared to another. These changes are influenced by various economic and political factors, causing the exchange rate to be dynamic and interconnected.

In other words, the exchange rate of a currency depends on its comparison to other currencies.

- Pip (Point in Percentage)

This is the smallest unit of price movement in forex. The pip size varies depending on the currency pair but is generally the last decimal point change, e.g., 0.0001 for major currency pairs.

Major currencies include EUR/USD, GBP/USD, AUD/USD, USD/JPY, USD/CHF, NZD/USD, and USD/CAD.

- Lot

This refers to the size of your trading position. The larger the lot, the greater the profit or loss potential. Beginners are advised to start with smaller lots to limit risks.

In forex, 1 lot equals 100,000 units of currency. For example, if you trade GBP/USD, 1 lot equals GBP 100,000.

- Leverage

This is a feature that allows you to trade positions larger than your capital. Leverage directly correlates to the amount of capital needed for each lot.

For instance, a trader with $1,000 capital using a 1:500 leverage can open a position of 1 lot (worth $100,000) while only needing $200 of their own capital.

Leverage can magnify profits, but it can also significantly amplify losses. Use leverage with extreme caution.

- Spread

This is the difference between the bid (sell) and ask (buy) price.

For example, if the buy price for EUR/USD is 1.07980 and the sell price is 1.07960, the spread is 2.0 pips.

Popular Forex Trading Strategies for Consistent Profits

1. Trend Following Strategy

This strategy focuses on following market trends. Traders applying this technique buy during uptrends and sell during downtrends.

Trends can be identified using technical indicators like Moving Averages. Entry strategies may involve oscillators such as stochastic, CCI, or MACD.

Advantages:

– Simple and easy to understand.

– High-profit potential if the trend continues.

Disadvantages:

– Requires precision in identifying the start and end of trends.

– Risk of significant loss if the trend reverses.

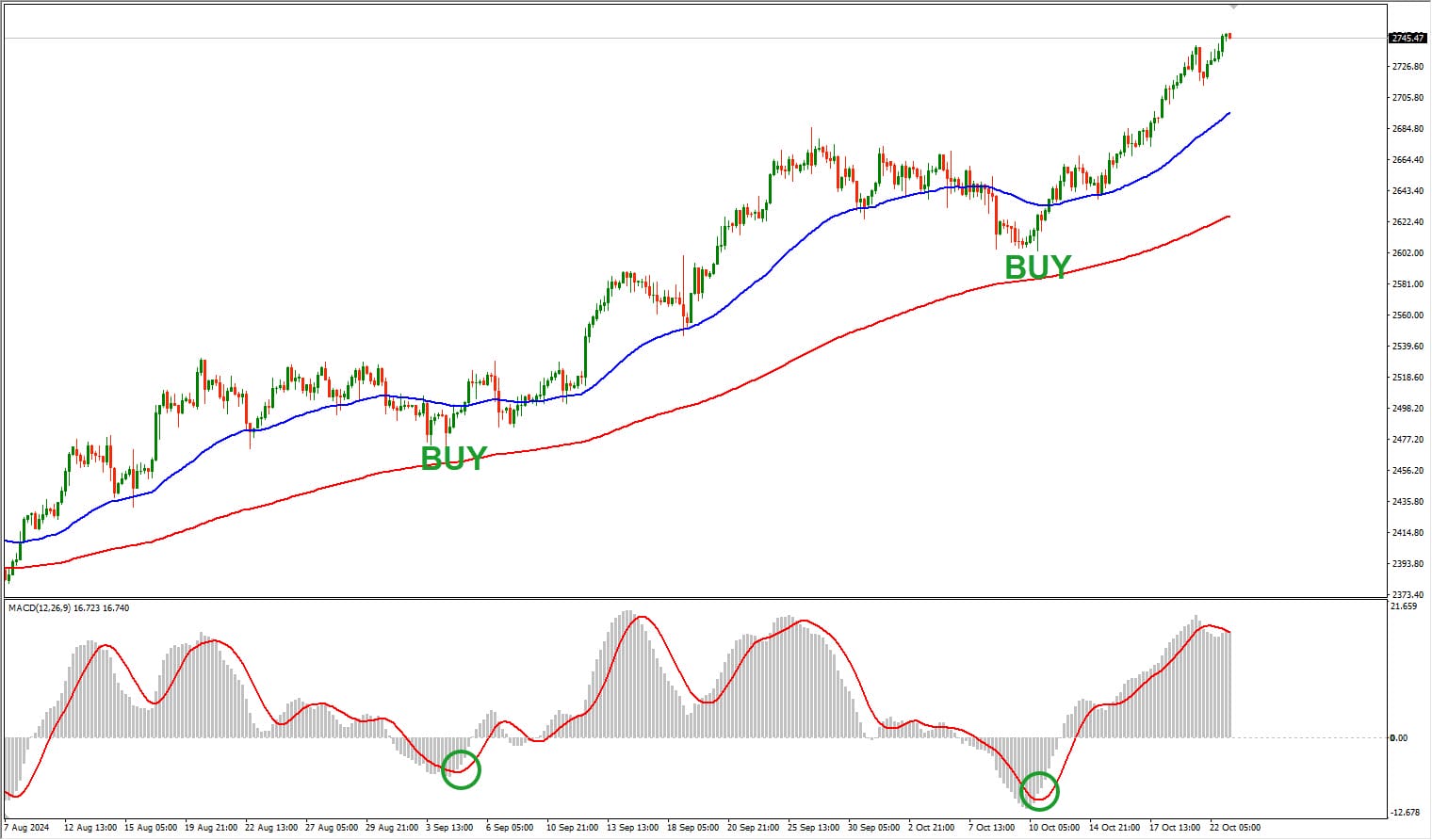

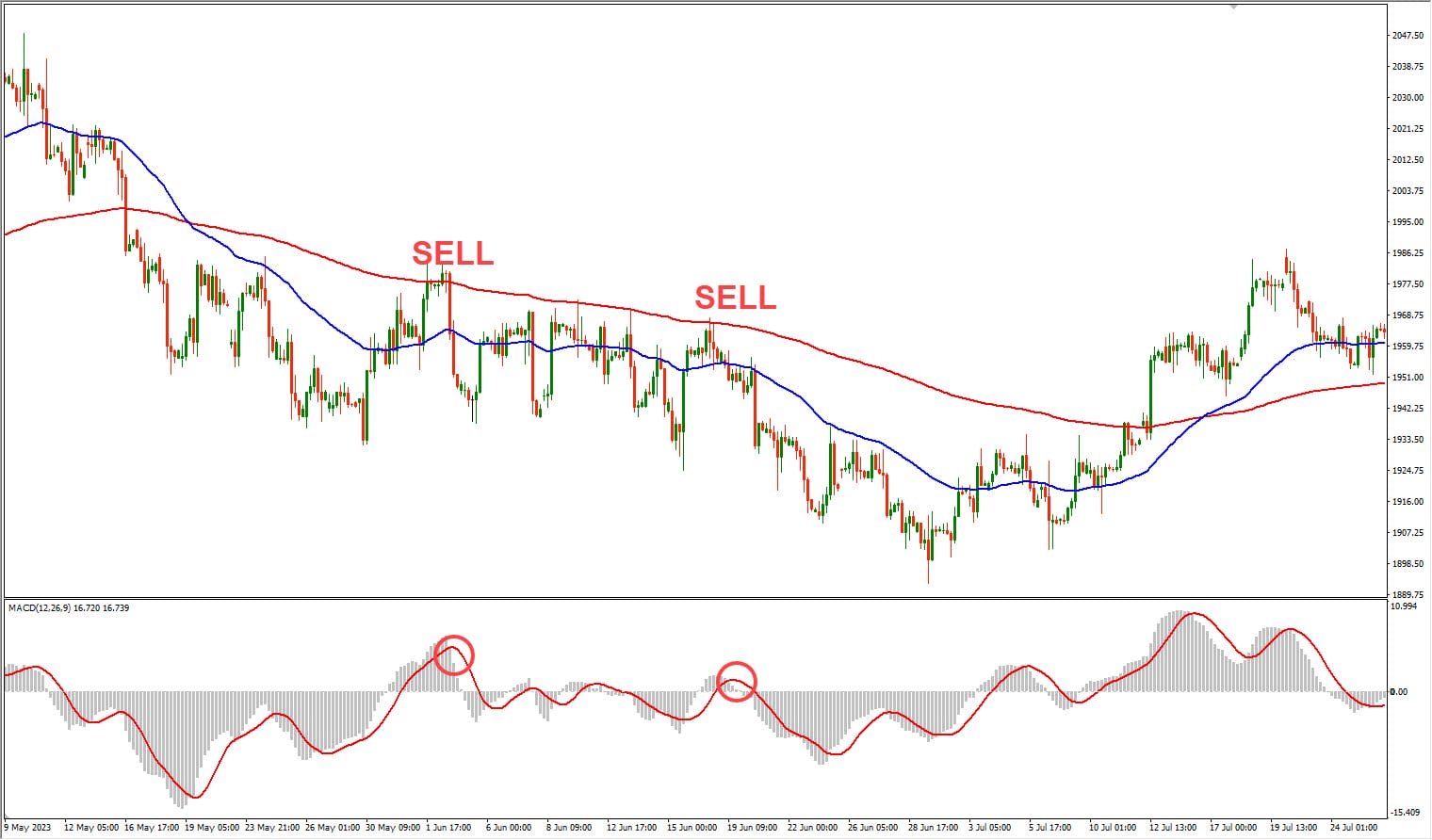

A classic and proven trend-following strategy involves combining Moving Averages with MACD:

Indicator Setup:

– Exponential Moving Average (EMA): 50 and 200 periods

– MACD

Strategy Rules:

– BUY ONLY when both EMAs are trending upward and MACD shows a bullish signal.

– SELL ONLY when both EMAs are trending downward and MACD shows a bearish signal.

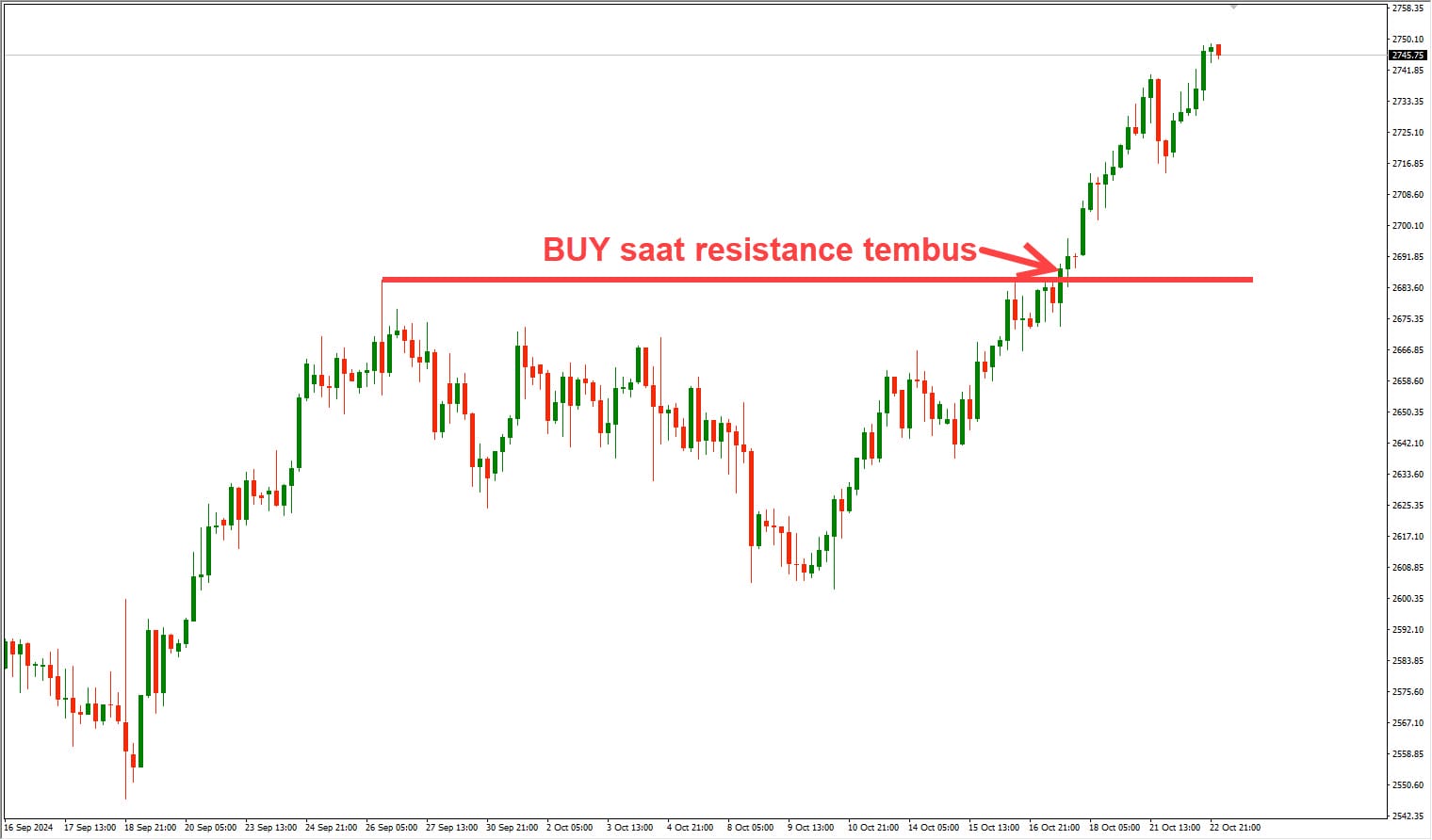

2. Breakout Trading Strategy

This strategy leverages moments when prices break through support or resistance levels. Traders using this strategy will buy only after the price breaks resistance and sell only after it breaks support.

Advantages:

– Potential for significant profits.

– Easy to identify using charts.

Disadvantages:

– Prone to false breakouts. Prices may appear to breach support/resistance but reverse soon after.

– Requires strict risk management.

Risk Management: The Key to Successful Forex Trading

Regardless of your strategy, risk management is crucial to achieving forex trading success. Key risk management points include:

- Stop Loss: Always use a stop loss to limit your losses. Stop loss automatically closes your position when the price reaches a specified level.

- Take Profit: Use take profit to secure your gains. Take profit automatically closes your position when the price reaches a specified level.

- Money Management: Never risk more than 1-2% of your capital on a single trade.

- Diversification: Don’t rely on just one strategy or currency pair. Diversify your portfolio to reduce risks.

Summary

Selecting the right forex trading strategy and mastering risk management is key to achieving consistent profits.

No strategy is perfect, and each has its strengths and weaknesses.

As a beginner, it’s essential to learn and test different strategies, find the one that matches your trading style and risk tolerance, and continually learn and adapt to market conditions.

Remember, patience, discipline, and consistency are the keys to success in forex trading. Avoid rushing to chase quick profits; focus on learning and developing proven strategies that suit your capabilities.

Happy trading!