The development of the derivatives industry, including Forex (FX), Precious Metals (Gold, Silver), Oil, and CFD Stock Indices such as Hang Seng, Nikkei, Dow Jones, Nasdaq, and S&P 500, continues to grow significantly in Indonesia. This growth is supported by the rise of social media and the increasing interest of young traders eager to learn about this field.

Futures trading offers a unique approach, enabling investors and traders to capitalize on both upward and downward price movements.

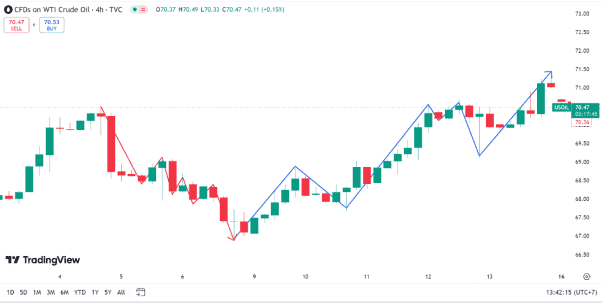

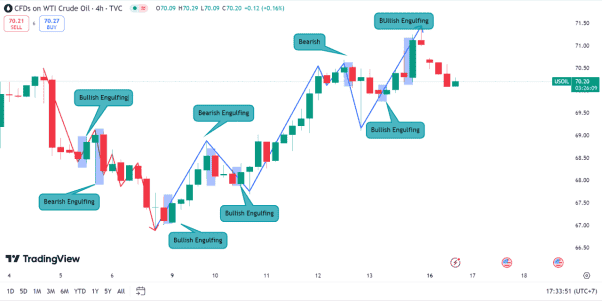

Below is an example of price movement patterns in Oil during Bullish and Bearish trends:

Image 1

Oil Price Movement

From this image, it is evident that both Bearish (downtrend) and Bullish (uptrend) patterns can create profit opportunities. Investors and traders can position themselves to sell during a Bearish trend and buy during a Bullish trend.

To predict whether prices will rise or fall, traders utilize two key methods:

- Technical Analysis

- Fundamental Analysis

Both methods aim to answer two critical questions:

- What is the potential price direction (target movement)?

- What is the risk level (stop-loss level)?

These considerations form the basis of traders’ transaction decisions, emphasizing the business-like approach to trading.

Key Outcomes in Trading Decisions:

- Buy or Sell

- Target Profit

- Risk on Loss

- Treatment Strategy

The good news is that of the 4 things there is 1 science that can provide 3 answers for traders and investors, namely the Japanesse Candle Stick Pattern.

History of Japanese Candlestick

Japanese candlestick is one of the technical analysis methods used to visualize price movements in financial markets, such as stocks, forex, or commodities. This method has a long history and originated in Japan in the 17th century.

Origins in Japan

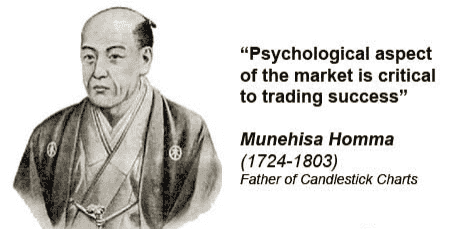

The Japanese candlestick was developed by a Japanese rice merchant, Munehisa Homma, during the Sakoku era (1639–1853). Homma, from the city of Sakata, used candlestick charts to analyze rice price fluctuations. His analysis revealed that price movements were influenced not only by supply and demand but also by market psychology.

Homma introduced candlestick patterns and the “Sakata Principles,” foundational guidelines for interpreting price movements based on candlestick patterns. These tools helped him accurately predict price trends, leading to significant success in rice trading.

Spread to the Western World

Though used in Japan for centuries, the method only reached the Western world in the late 20th century. Steve Nison, an American technical analyst, popularized Japanese candlesticks through his book Japanese Candlestick Charting Techniques in 1991, bringing them into the global financial markets.

Basic Components of Japanese Candlesticks

Japanese candlesticks consist of four primary elements:

- Open: Opening price.

- Close: Closing price.

- High: Highest price.

- Low: Lowest price.

Two visual components are:

- Body: The central part showing the difference between the opening and closing prices.

- Shadow/Wick: The vertical lines above or below the body, representing the highest and lowest prices.

Modern Relevance

Japanese candlesticks remain one of the most popular price visualization tools due to their ability to reflect market psychology. Traders make decisions based on these patterns, which offer insights into price movements.

A notable insight is:

“Psychology is the most essential aspect for achieving success.”

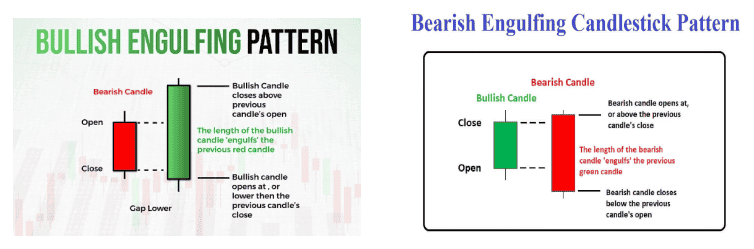

Patterns: Bullish and Bearish Engulfing

These patterns are widely used to predict market trends and inform trading decisions, including entry levels, profit targets, and stop-losses.

Bullish and Bearish Engulfing Formation on Oil H4 Chart

The Bullish and Bearish Engulfing method easily provides information related to Entry Levels, upward or downward trajectories along with the risk Stoploss level of each decision placement in the market so that investor friends and novice traders are easily able to understand decision making quickly and easily in placing Transaction Positions in the market.

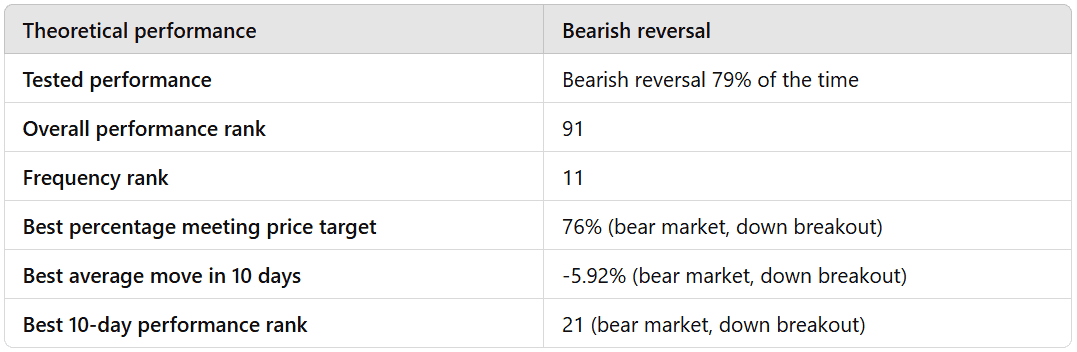

Bearish Engulfing (By Bulkowski):

All ranks are out of 103 candlestick patterns with the top performer ranking 1. “Best” means the highest rated of the four combinations of bull/bear market, up/down breakouts.

The above numbers are based on hundreds of perfect trades

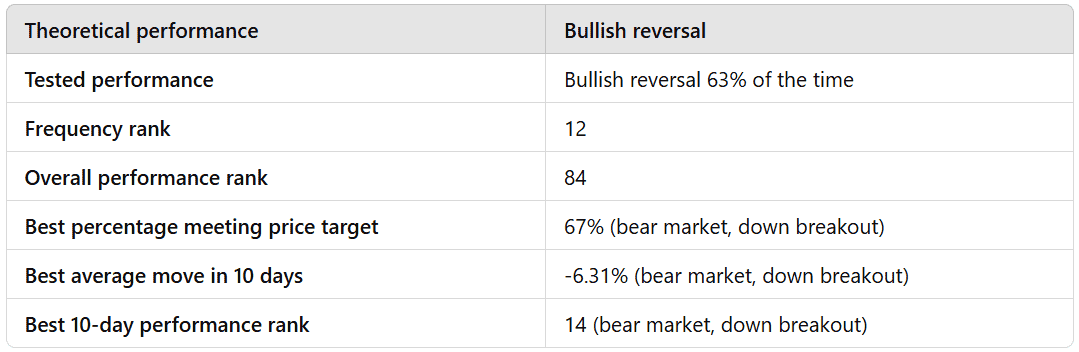

Bullish Engulfing (By Bulkowski):

The above numbers are based on hundreds of perfect trades.

In summary, several key points can be easily understood:

- Forex transactions, Stock Index Futures, CFDs, and Precious Metals carry two potential outcomes: both risks of loss and opportunities for profit.

- Forex transactions, Stock Index Futures, CFDs, and Precious Metals involve knowledge that can be learned easily and simply.

- There are many trading methods to learn, one of which is the Japanese Candlestick method.

Traders and investors have the opportunity to easily understand the decision-making process using Japanese Candlestick techniques.lfing patterns, follow the link below for detailed insights.