Review

Expected Earnings and Revenue

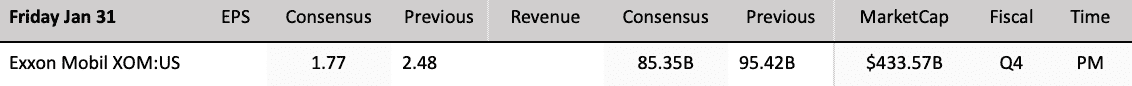

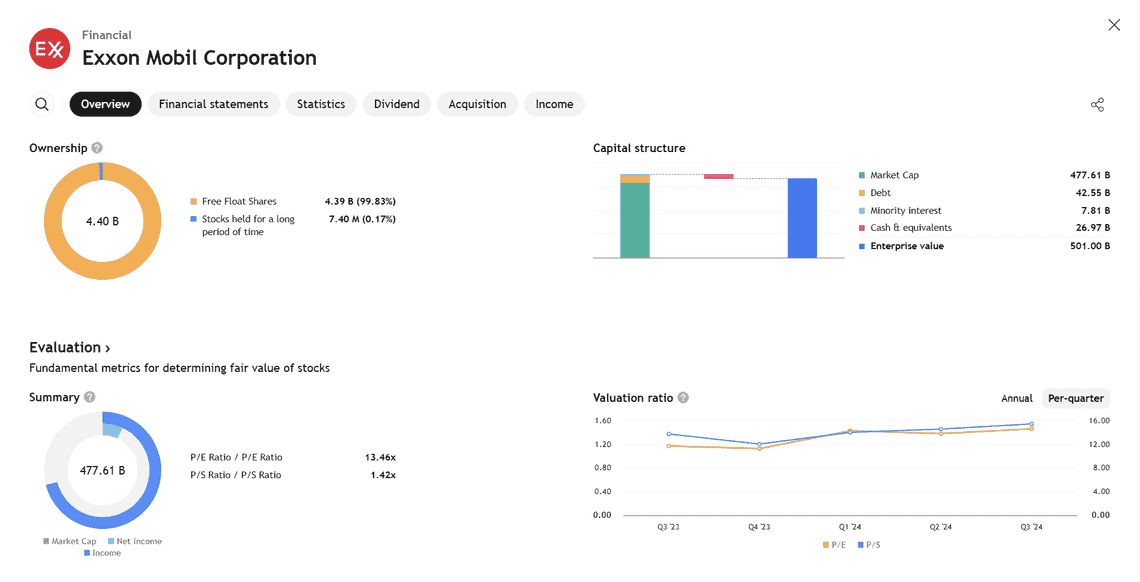

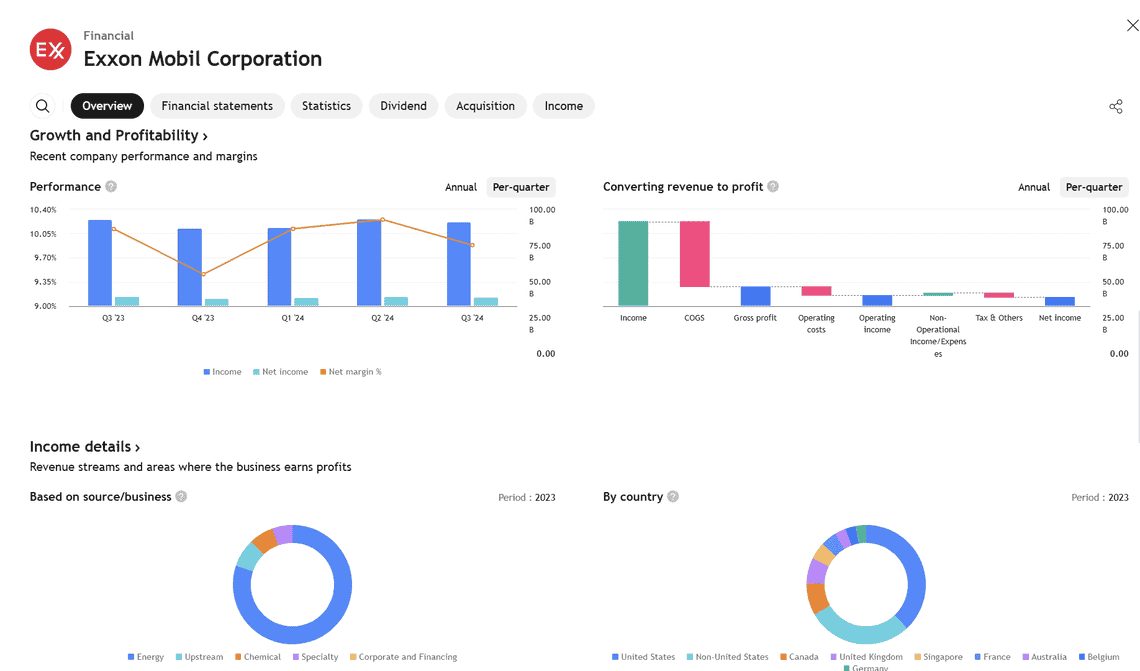

- Earnings Per Share (EPS): Exxon Mobil is expected to report $1.58 per share, marking a 36.3% year-over-year decline.

- Revenues: Estimated at $87.12 billion, showing a 3.3% increase compared to the previous year.

Earnings Estimate Revisions

- Over the last 30 days, the consensus EPS estimate has been revised 1.77% higher, reflecting analysts’ reassessment of the company’s earnings outlook.

- This upward revision does not necessarily indicate widespread confidence, as individual revisions may not always align with the overall consensus.

Earnings Surprise Prediction (Zacks Earnings ESP)

- Zacks Earnings ESP for Exxon is -2.38%, indicating a higher likelihood of missing estimates than exceeding them.

- A negative Earnings ESP combined with a Zacks Rank of #3 (Hold) suggests that Exxon is not a strong candidate for an earnings beat.

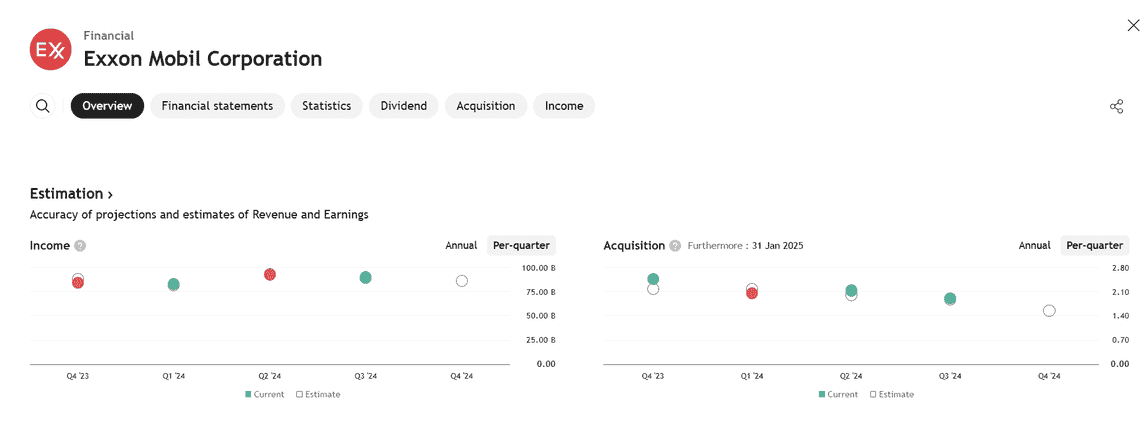

Past Earnings Surprise History

- Exxon beat EPS estimates in three of the last four quarters, including a surprise of +0.52% in the last reported quarter (Q3 2024), where earnings were $1.92 compared to the expected $1.91.

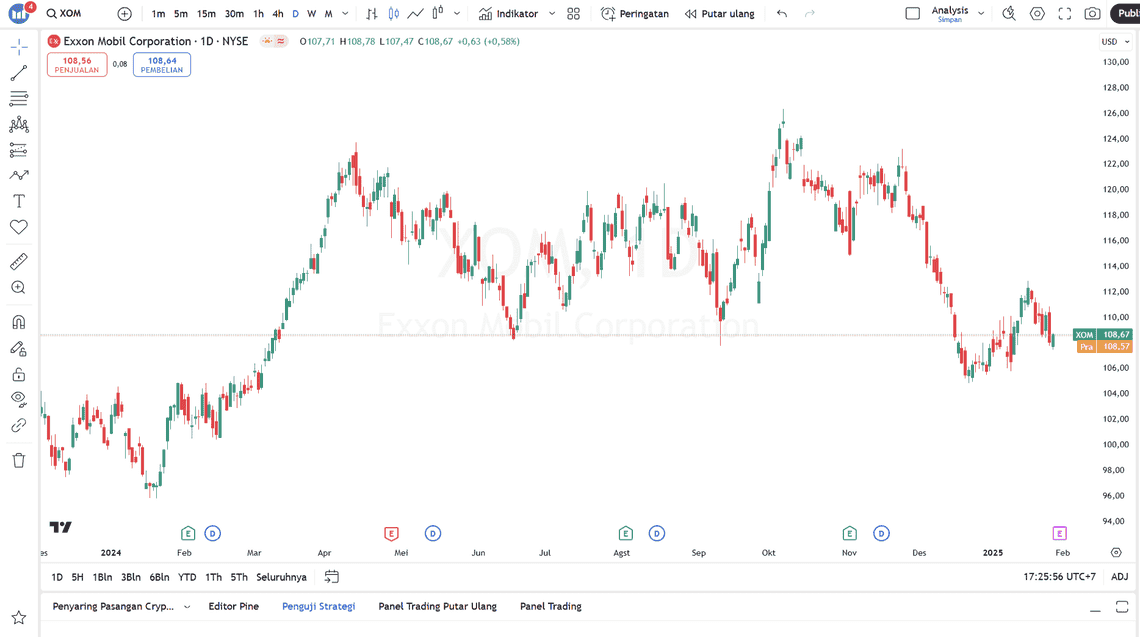

Stock Price Impact

- The stock’s immediate price movement will depend heavily on the upcoming earnings report and management’s commentary on business conditions during the earnings call.

- Positive earnings results could lead to a higher stock price, while a miss could push the stock lower.

Factors Influencing Stock Movement

- While an earnings surprise can influence stock movement, it is not the only factor. Stocks can rise even with earnings miss due to unforeseen catalysts or other positive factors.

- Conversely, even with an earnings beat, a stock can drop if other disappointing factors emerge.