Review

Leadership Changes:

- Intel will report its Q4 earnings after the bell on Thursday, marking its first report since CEO Pat Gelsinger was ousted due to frustrations with his turnaround efforts.

- The company is currently led by co-CEOs David Zinsner (CFO) and Michelle Johnston Holthaus (CEO of Intel Products), with a search for a permanent CEO underway.

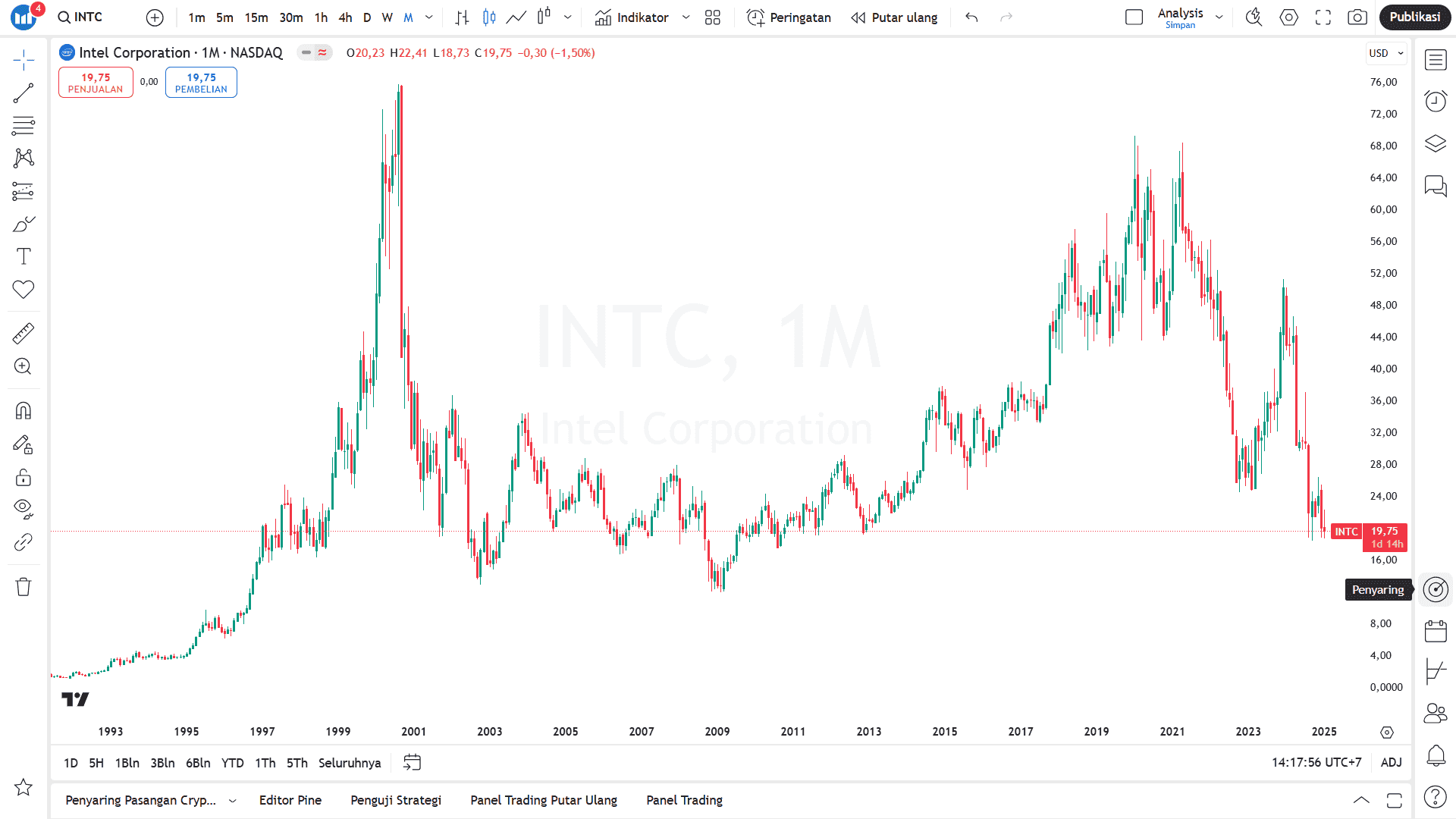

Stock Performance:

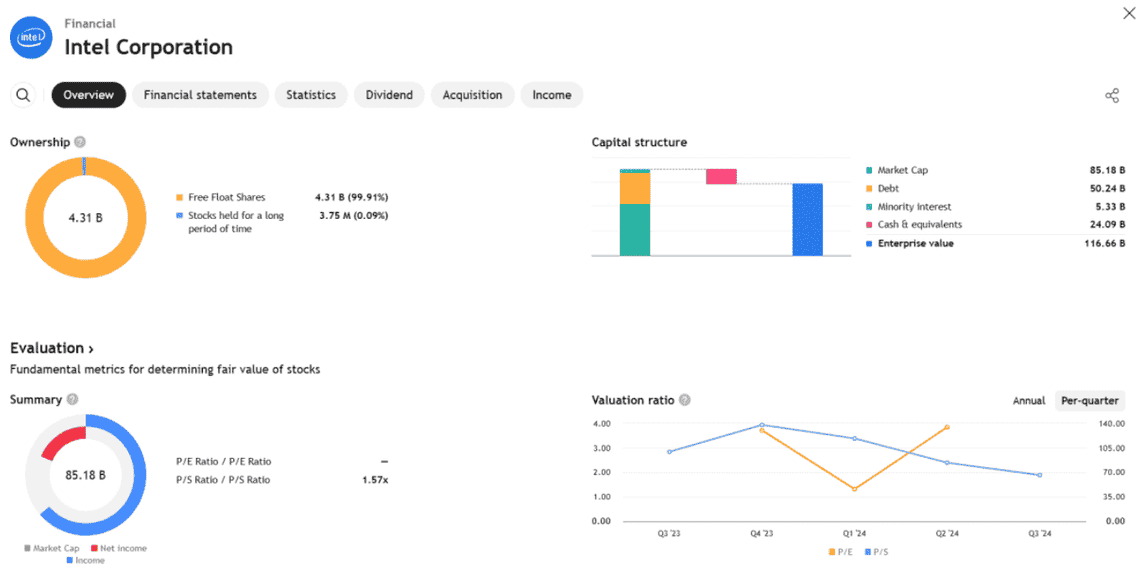

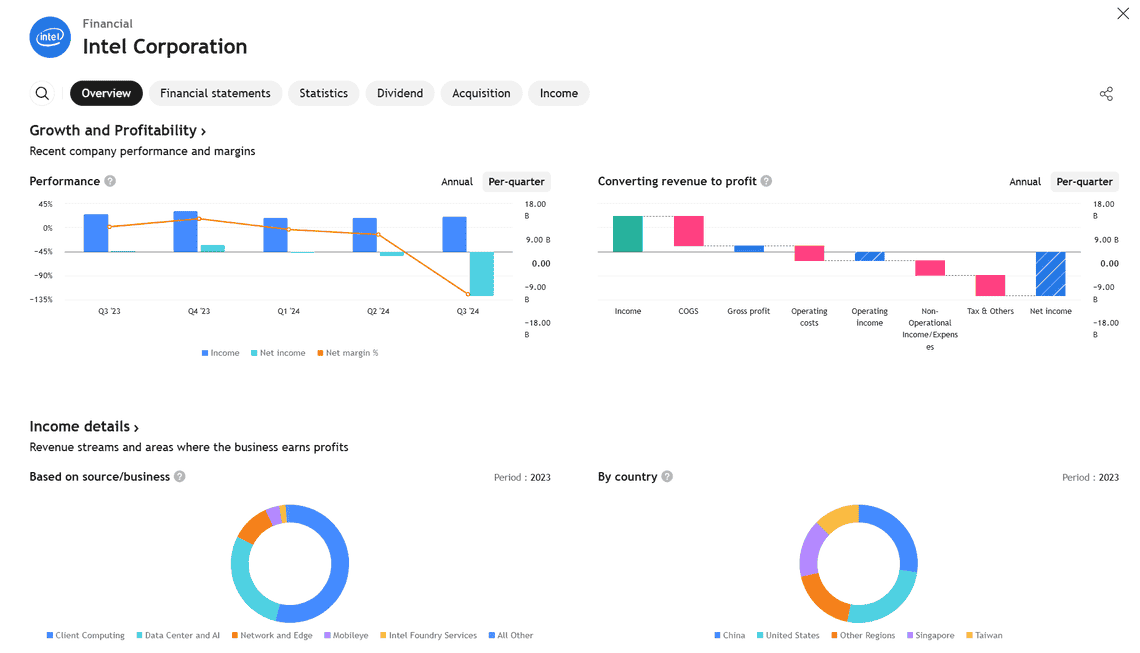

- Intel’s shares have fallen 54% over the past year, and it reported its largest quarterly loss in history. In contrast, rivals like AMD have also seen declines, while Nvidia gained 93% in the last year.

Business Struggles:

- Intel’s foundry business, which produces chips for Intel and third parties, continues to drag on revenue, despite securing agreements to manufacture chips for Amazon and Microsoft.

- Intel is struggling with a flat PC market, despite hopes that AI PCs would help boost sales in 2024. PC shipments only rose by 1% in 2024.

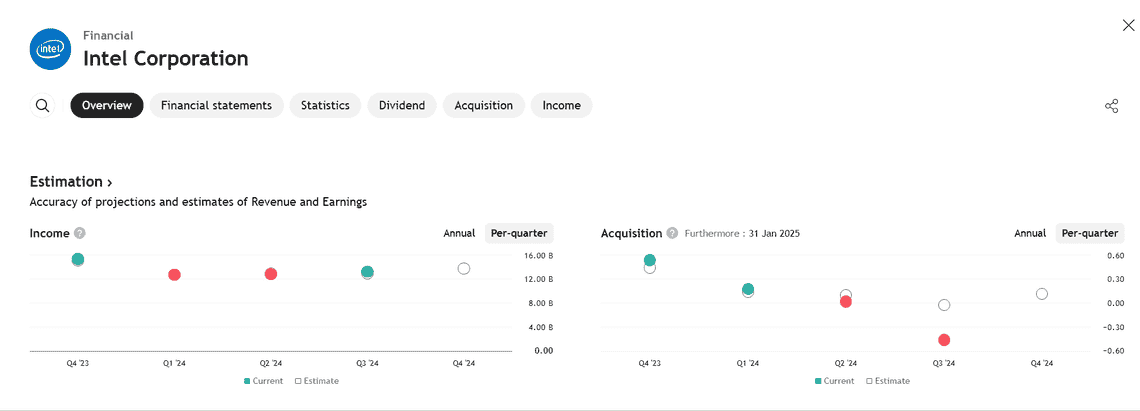

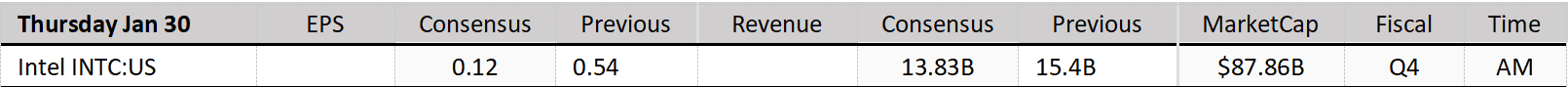

Earnings Expectations:

- Intel is expected to report earnings of $0.12 per share and revenue of $13.8 billion for Q4, down from $0.54 per share and $15.4 billion in the previous year.

- Specific business areas:

- Client Computing: Expected to drop from $8.8 billion to $7.8 billion.

- Data Center: Expected to drop from $3.9 billion to $3.3 billion.

- Foundry: Expected to rise from $291 million to $4.5 billion.

- Challenges in AI and Data Centers:

- Intel’s data center business faces challenges competing with Nvidia, especially in AI chips. Intel is working on its own AI chips but lags behind market leaders, with no clear timeline for catching up.

- The company is continuing efforts to build new research and manufacturing facilities in the US, but the broader macroeconomic concerns overshadow the excitement around AI PCs. Industry experts remain optimistic about the potential impact of on-device AI, though the inflection point may be delayed.