Review

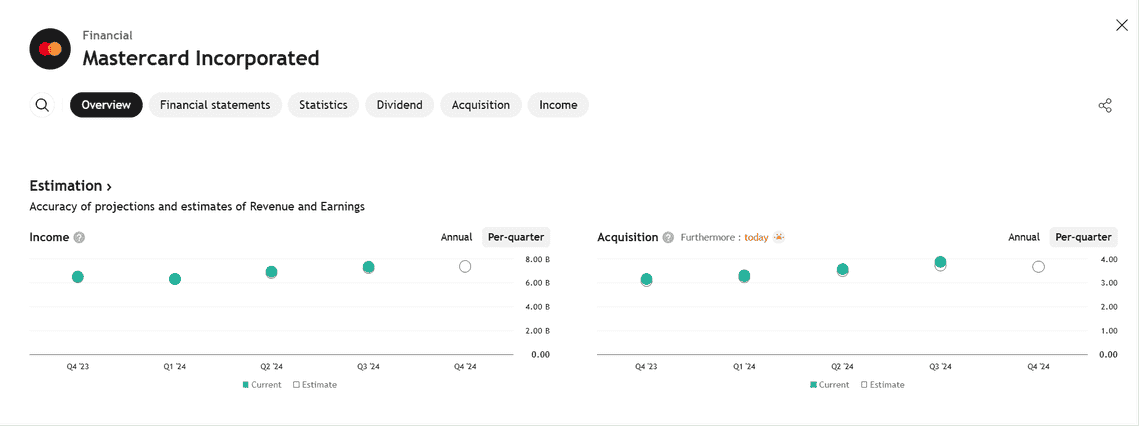

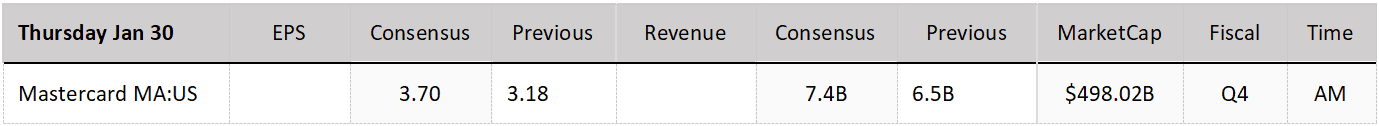

Earnings Report Projections:

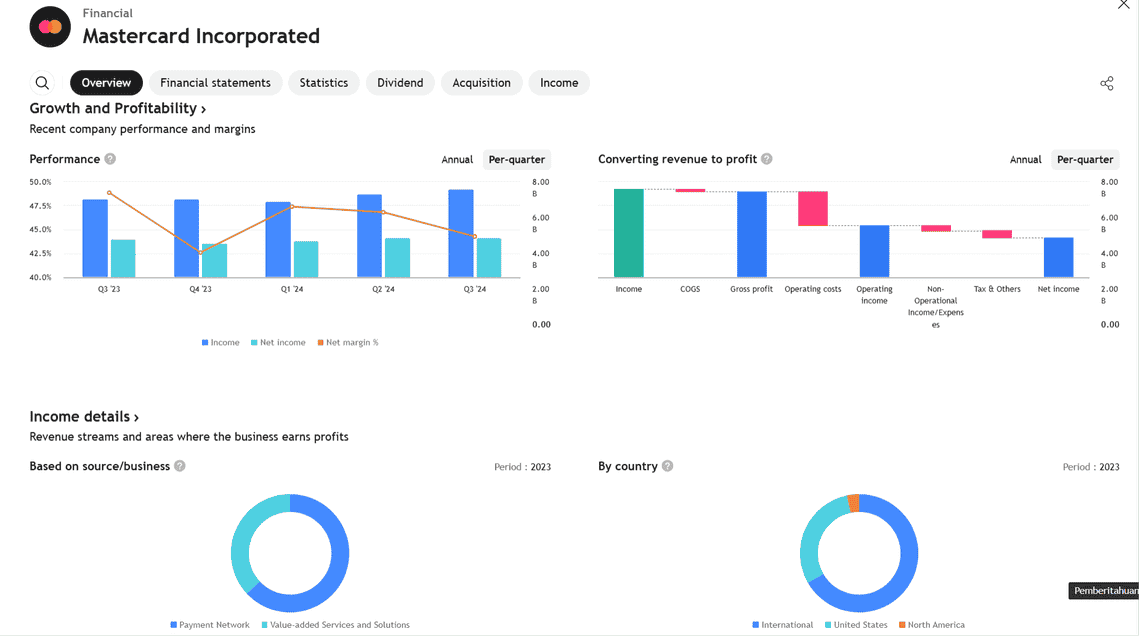

- Earnings per Share (EPS): MasterCard is expected to report an EPS of $3.69, a 16% year-over-year increase.

- Revenue: Expected to reach $7.38 billion, up 12.8% from the same quarter last year.

- Estimate Revisions:

- The EPS estimate has been revised down by 0.42% over the past 30 days, reflecting analysts’ decreased expectations.

Zacks Earnings ESP:

- Most Accurate Estimate for EPS is lower than the Zacks Consensus Estimate, with an Earnings ESP of -0.08%.

- This indicates that analysts are more bearish on MasterCard’s earnings prospects for this quarter.

- A negative Earnings ESP does not necessarily mean an earnings miss, but it makes a positive surprise less likely.

- Earnings Surprise History:

- MasterCard has exceeded EPS estimates in the last four quarters, with a positive surprise of 4.29% in the most recent quarter (actual EPS of $3.89 vs. expected $3.73).

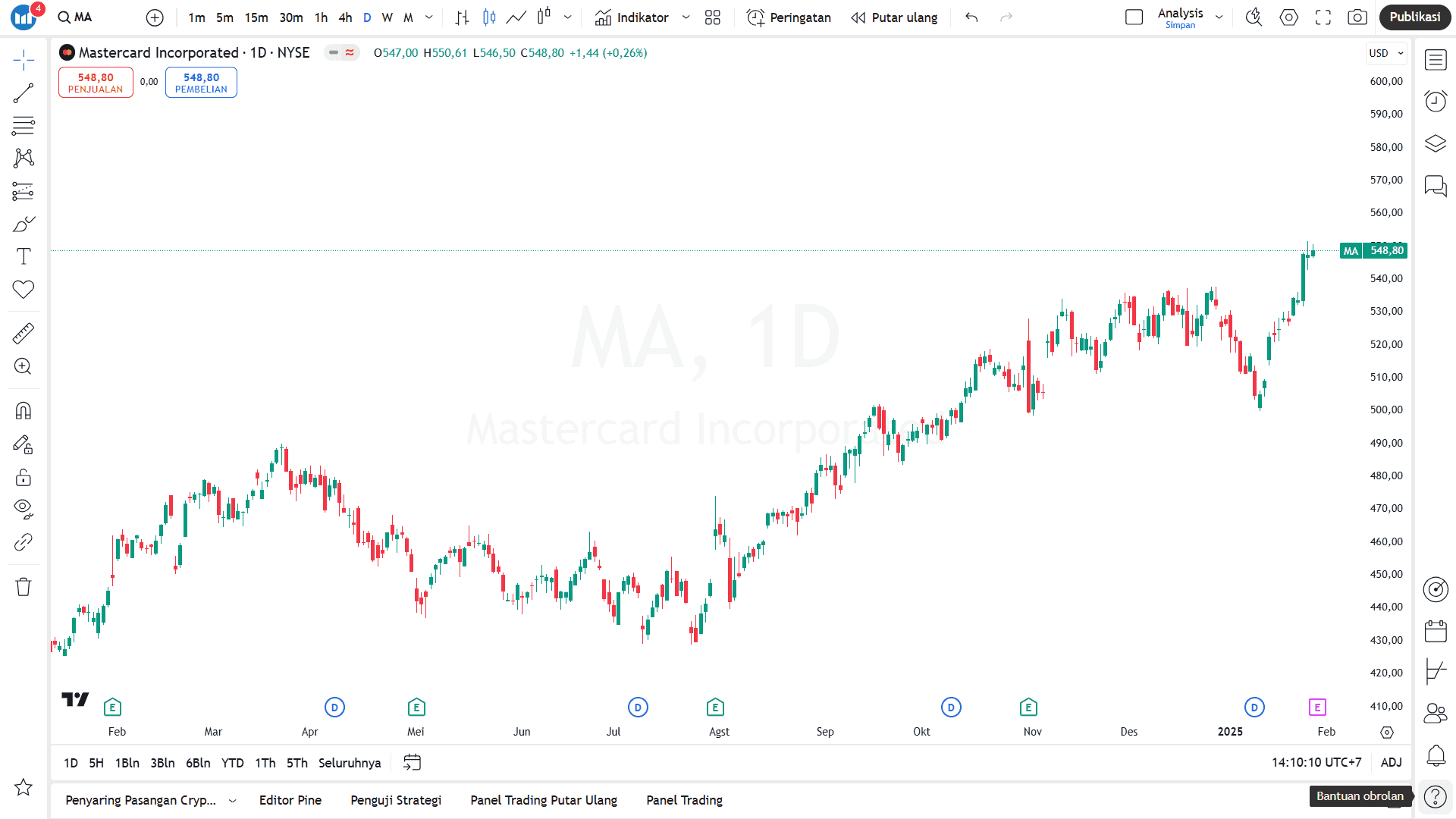

Conclusion:

- While there is a chance for a positive earnings surprise, the combination of negative Earnings ESP and Zacks Rank of #3 (Hold) suggests that MasterCard is less likely to beat EPS estimates this time.

- Investors should consider other factors, not just earnings performance, when deciding whether to invest before the earnings release.

- This version is clearer and more structured.