Review

Apple (AAPL) is preparing to announce its first-quarter earnings amid concerns over weaker-than-expected iPhone sales despite the launch of its Apple Intelligence platform. Analysts from Jefferies, Loop Capital, and Oppenheimer recently downgraded Apple’s stock, citing competition in China and a lack of impactful AI innovations to drive upgrades.

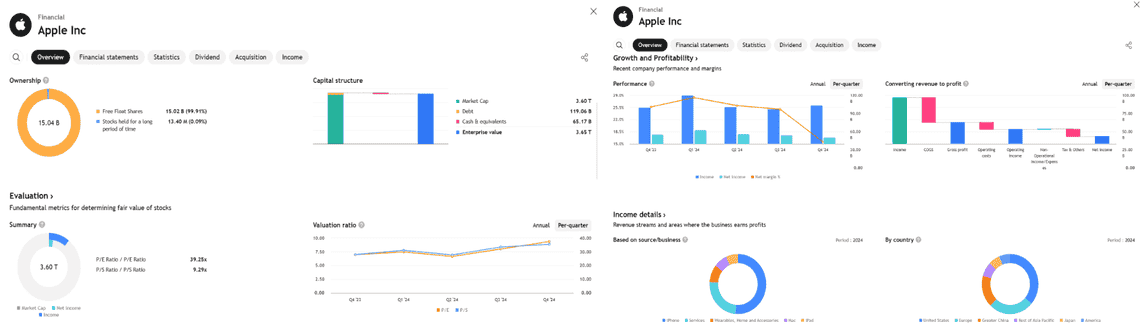

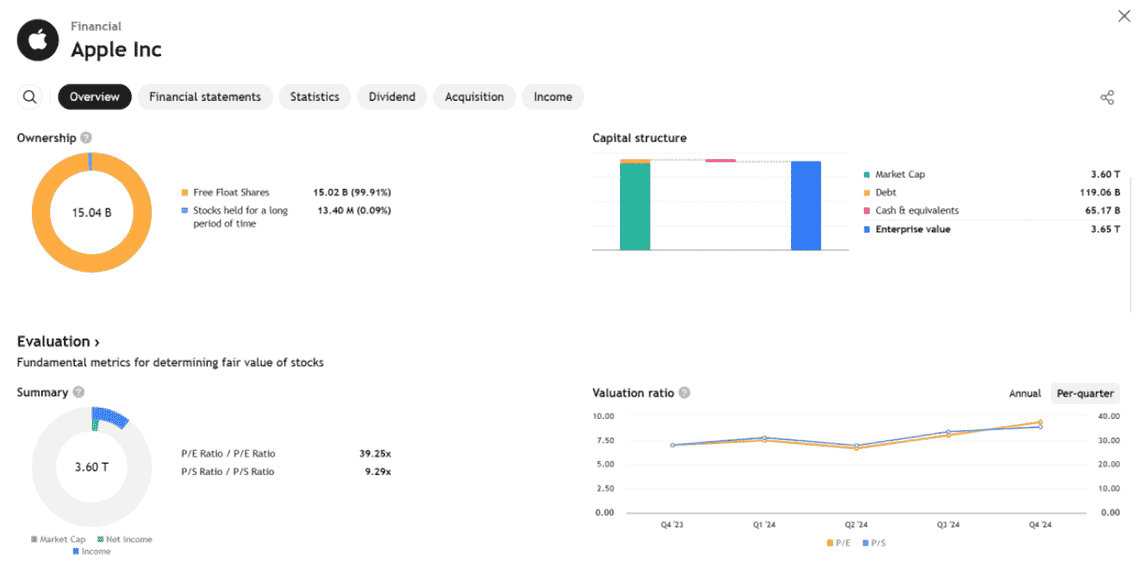

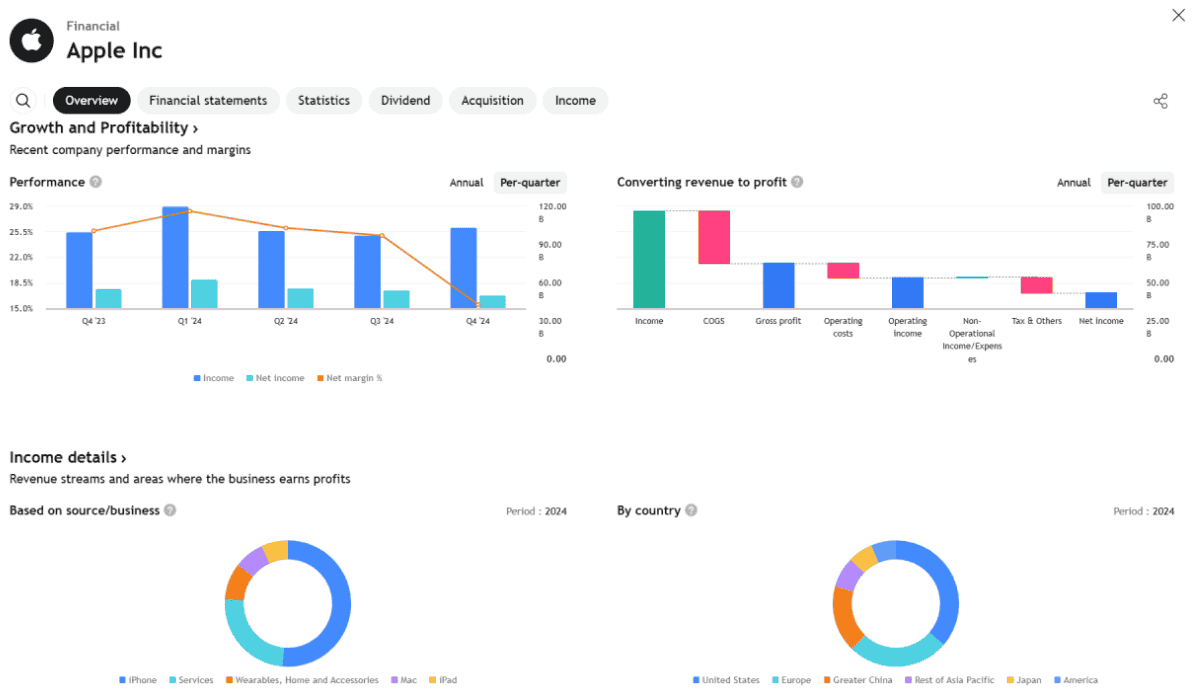

Market Performance & Projections:

iPhone market share fell by 1% year-over-year in Q4, dropping to 23% despite a 3% increase in overall smartphone shipments.

- For the quarter, analysts expect earnings per share (EPS) of $2.35 on revenue of $124.1 billion, up from $2.18 EPS and $119.5 billion in revenue a year ago.

- iPhone sales are projected at $71 billion, up from $69 billion, while Services revenue is expected to reach $26 billion, compared to $23.1 billion last year.

- Revenue from Greater China is estimated at $21.5 billion, slightly higher than last year’s $20.8 billion.

- Challenges & New Product Launches:

- China remains a persistent challenge for Apple, with declining sales in recent years due to currency issues and lower demand for iPhones and iPads.

- Despite these difficulties, Apple plans to launch several new products, including an entry-level iPhone SE, new iPads, and MacBook Airs, which may boost revenue in coming quarters.

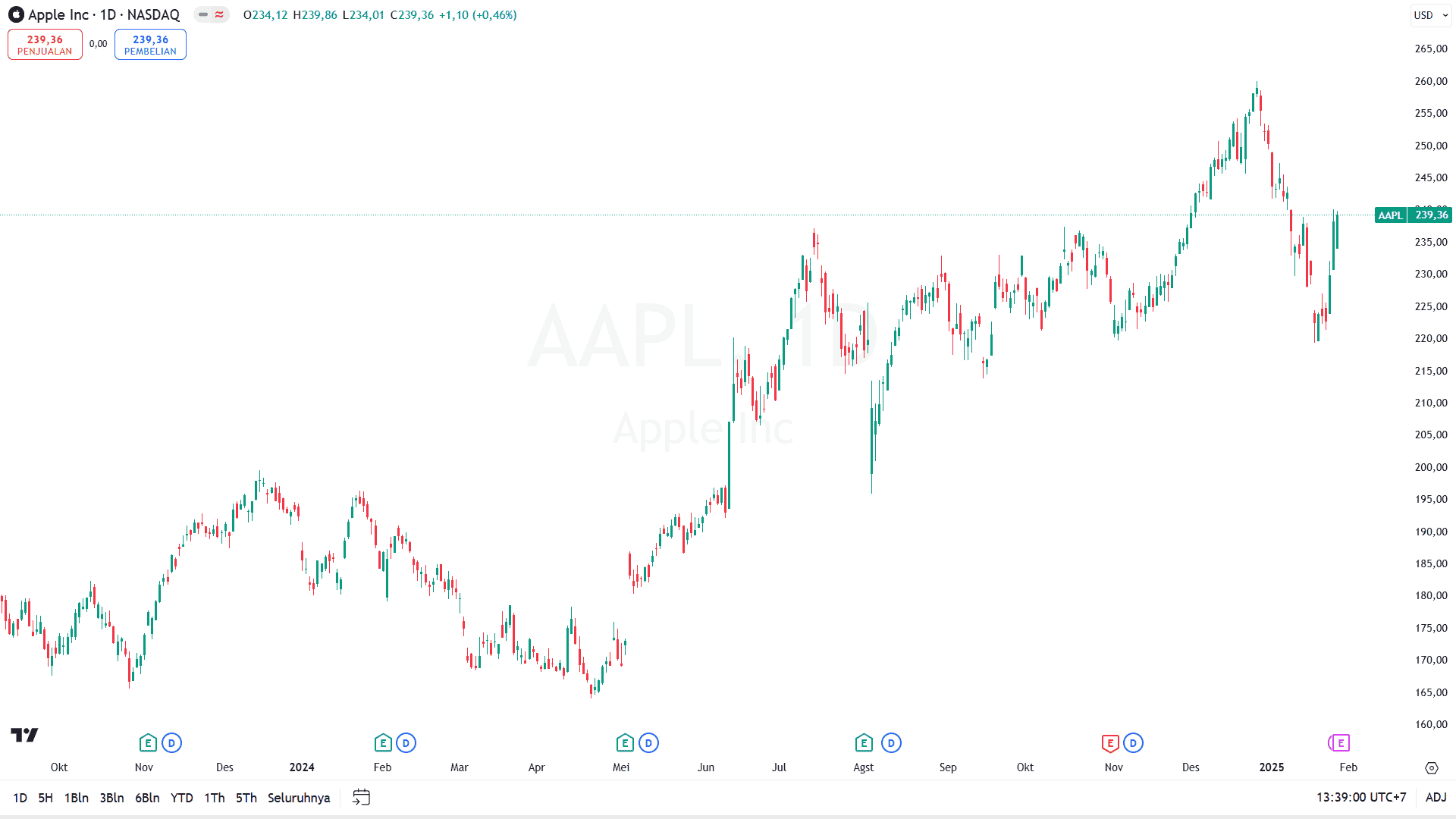

Stock Comparisons:

- Over the last 12 months, Apple shares have risen 24%, similar to Google’s 27% gain.

- Nvidia outperformed significantly, up 102%, while Meta gained 69%.

- Microsoft lagged with an 8% increase.

- Apple’s efforts to leverage its AI platform and upcoming product launches will be critical in sustaining its growth trajectory amid competitive market pressures.