Wall Street is closely watching Citigroup Inc. (ticker: C) as it prepares to release its earnings report for the fourth quarter of 2024, scheduled for January 15. This report is expected to be a major catalyst for the stock price—shares could rally if results exceed expectations or face downward pressure if they disappoint.

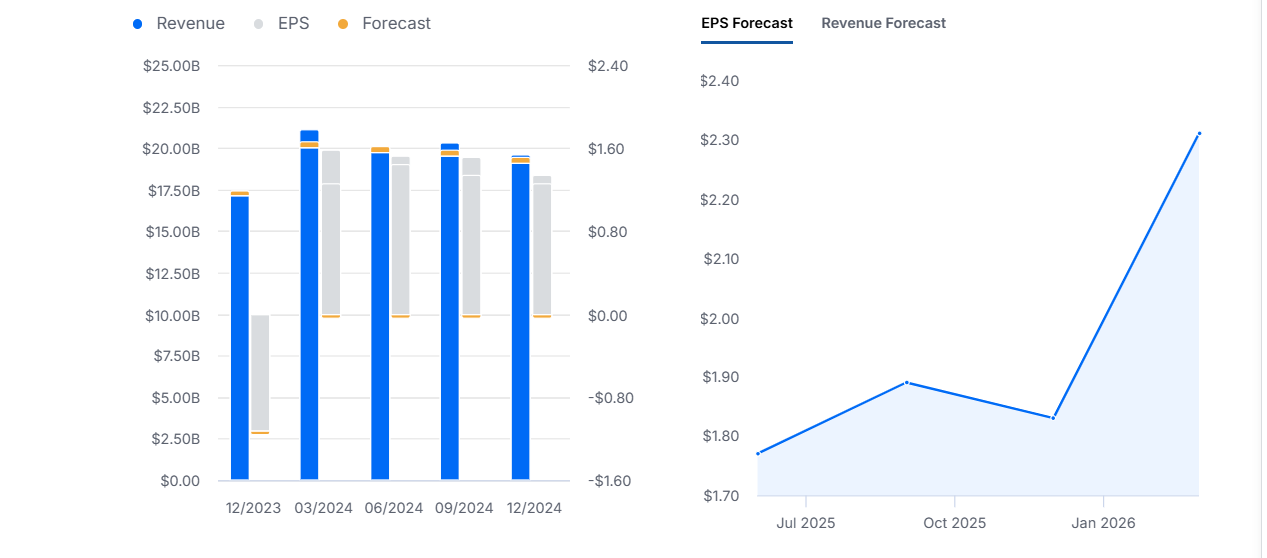

Citigroup is projected to report earnings of $1.23 per share, reflecting a 46.4% increase year-over-year. Revenue is expected to reach $19.49 billion, representing an 11.8% gain from the same period last year. These estimates suggest a solid recovery and growth in the bank’s core operations.

Revenue and EPS Forecast

Notably, the consensus earnings per share (EPS) estimate for this quarter has been revised upward by 0.31%, signaling growing confidence among analysts in Citigroup’s earnings prospects. Supporting this view, Zacks Earnings ESP (Expected Surprise Prediction) indicates a +0.32% chance of a positive earnings surprise.

With a Zacks Rank #3 (Hold), Citigroup has a fair likelihood of beating consensus EPS expectations. This is further backed by the company’s recent performance—it has exceeded consensus earnings estimates for the past four consecutive quarters, reinforcing the positive sentiment.

Overall, expectations are high for Citigroup heading into its Q4 2024 earnings release. If the forecasts hold true, Citigroup could not only strengthen its position in the market but also generate positive momentum for the broader banking sector.

Earning Report Reaction History