In futures trading, the use of a smaller capital compared to the total transaction value is widely known as LEVERAGE.

Leverage is a feature that allows traders to control a futures contract position in the market with a relatively small amount of capital. This “magnifying effect” illustrates that the amount of margin placed in the market corresponds proportionally to the actual contract value.

How Leverage Works

Leverage is typically expressed in ratios, such as 1:10, 1:50, 1:100, or even 1:500. These ratios indicate how much position a trader can control in comparison to their capital.

Example:

- With a leverage ratio of 1:100, a trader only needs to provide 1% of the total position value as margin (transaction collateral).

- If a trader wants to open a position worth $100,000 with a leverage of 1:100, they only need to provide a margin of $1,000 as collateral.

Picture I

Leverage

Leverage offers several benefits, including:

- Increasing Profit Potential

With the ability to control larger positions, the potential for profit increases significantly if market predictions are accurate. - Optimizing Capital Usage

Traders do not need to provide the full amount of capital to control large positions, enabling broader participation in the forex market. - Access to Larger Markets

Leverage allows traders to manage substantial market transaction values with relatively affordable margin requirements. - Diversification

Traders can allocate their funds across various instruments, creating opportunities for diversification.

However, leverage also comes with higher risks, as potential losses can be amplified just as much as potential gains. Therefore, it is crucial to use leverage wisely and fully understand the risks associated with it.

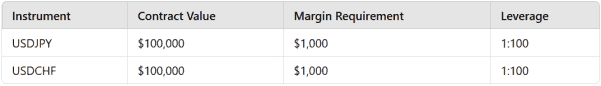

Leverage will always be related to the Contract Value information of each instrument being traded. Here is a glimpse of the information on some Instrument Contract Values:

This means that to trade USDJPY worth $100,000 an Investor or Trader only needs a guarantee fund in his transaction of $ 1000.

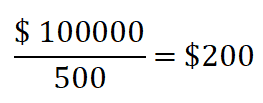

In its development, the amount of leverage value has changed, namely 1: 500, meaning that to make transactions on the USDJPY instrument is only needed.

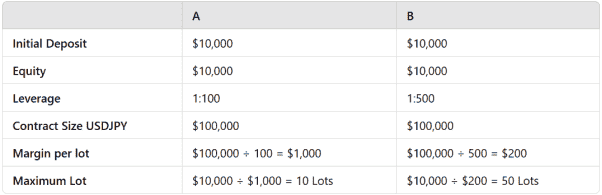

What are the Benefits and Risks of a larger Leverage Value if an Investor opens a Futures Trading Account of $10,000.

We will look at the comparison of two Leverage values namely Leverage value of 100 and Leverage value of 500 towards managing Transactions.

From the illustration above, it is clear that the utilization of capital value will be greater with the use of 1:500 leverage.

The ability to maximize the value of capital on the placement of transactions in the market will certainly provide great opportunities and at the same time will reduce the ability of Capital Value in maintaining its position in the market when prices are opposite to the open position so that judgment and wisdom are needed in managing transactions by assessing market opportunities and risks.