3M Company (MMM) is scheduled to release its first-quarter earnings report on Tuesday morning. Investors are hoping for solid results and more clarity regarding the rising trade war risks under President Donald Trump.

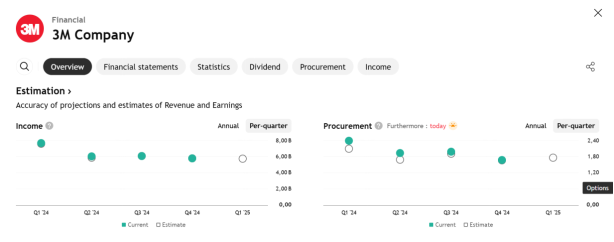

Q1 2025 Performance Estimates:

- EPS (Earnings Per Share): Projected at $1.77 (down from $2.39 a year ago).

- Revenue: Estimated at $5.8 billion (down from $7.7 billion last year).

Note: This decline is partly due to the spinoff of its healthcare unit, Solventum, on April 1, 2024.

Investor Sentiment and Expectations:

- Investors are looking for a strong earnings beat (results exceeding estimates).

- Forward guidance is also critical:

- In January, 3M projected 2025 sales growth of 2.5%.

- Organic sales grew by 1% in Q1 2024—marking the first positive growth in four quarters.

2025 Earnings Outlook:

- EPS guidance is projected between $7.60 and $7.90, with consensus at $7.78.

External Risk Factors:

- Roughly 45% of 3M’s revenue comes from outside the U.S., with 30% from the Asia-Pacific region.

- While retaliatory tariffs amid trade war tensions remain a low-probability risk, investors are staying cautious.

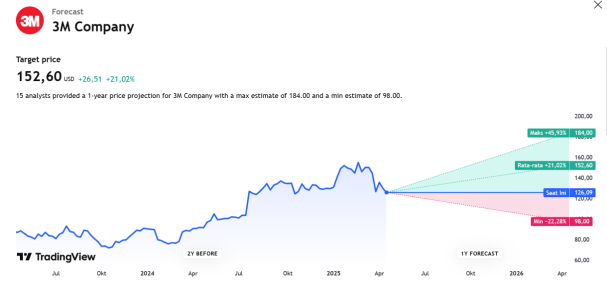

- Morgan Stanley maintains a Sell rating on 3M stock with a $130 price target.

Market Reaction & Volatility Expectations:

- 3M stock has traded relatively flat since the November 5 presidential election, whereas the S&P 500 and Dow Jones have fallen 11% and 10%, respectively.

- The options market suggests a potential 6% price swing for 3M following its earnings release.

Earning Projection Prediction

WHAT THE ANALYST STATED