Procter & Gamble Earnings Report

Consumer goods giant Procter & Gamble (NYSE: PG) is scheduled to report its financial results today before the market opens. Here’s what investors need to know.

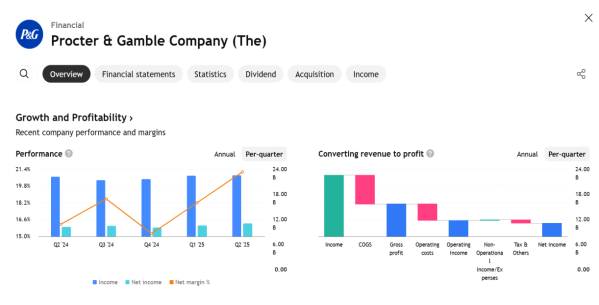

Last quarter, Procter & Gamble exceeded analysts’ earnings expectations by 1.3%, posting revenue of $21.88 billion—up 2.1% year-over-year. It was a solid quarter for the company, with impressive outperformance on EBITDA estimates, although gross margin was in line with analysts’ forecasts.

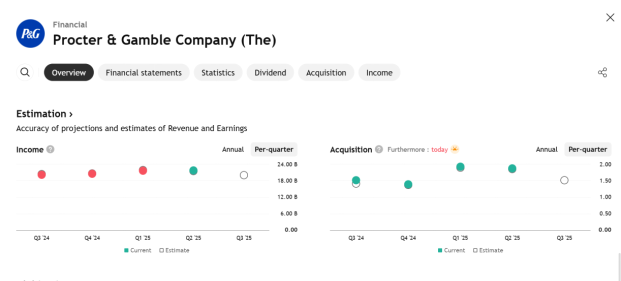

For the current quarter, analysts project Procter & Gamble’s revenue will remain flat year-over-year at $20.17 billion, consistent with revenue from the same quarter last year. Adjusted earnings per share (EPS) are expected to come in at $1.53 per share.

Over the past 30 days, analysts have reiterated their estimates, signaling that they expect the company’s operations to stay on track heading into the earnings release. Procter & Gamble has missed Wall Street’s revenue estimates four times in the past two years.

Looking at Procter & Gamble’s industry peers in the consumer goods sector, some have already reported their Q1 results, offering clues about what to expect. Kimberly-Clark’s revenue fell 6% year-over-year, missing analyst expectations by 1%, while WD-40 reported a 5% revenue increase—yet still came in 5.4% below estimates. WD-40 shares dropped 8.7% following the announcement.

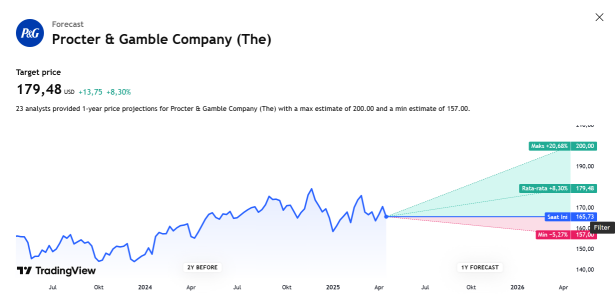

Investors in the consumer goods sector have remained steady ahead of earnings season, with share prices staying mostly flat over the past month. Procter & Gamble’s stock has risen 3.6% during the same period and enters the earnings announcement with an average analyst price target of $176.65, compared to its current share price of $168.25.

Earning Projection Prediction

WHAT THE ANALYST STATED