Earnings Announcement

Boeing is scheduled to release its quarterly earnings report on Wednesday morning, April 23, 2025.

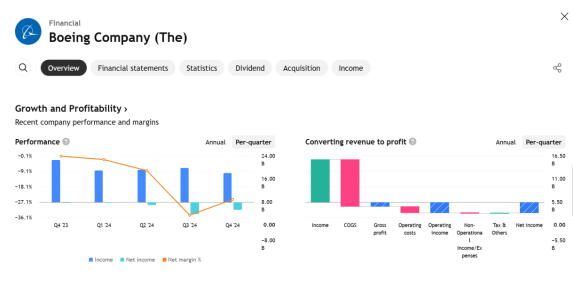

Previous Quarter Performance

- Boeing missed analyst revenue expectations by 6.4% in the previous quarter.

- Revenue stood at $15.24 billion, down 30.8% year-over-year.

- The quarter also revealed a significant gap between actual and expected adjusted operating income.

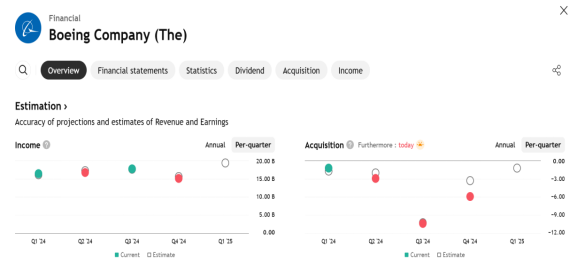

Current Quarter Projections

- Analysts forecast Boeing’s revenue to grow by 18.4% to $19.62 billion.

- Adjusted loss is expected to be -$1.28 per share.

- Revenue is projected to rebound from a 7.5% decline in the same quarter last year.

Analyst Sentiment

- Despite missing expectations four times in the past two years, analysts have largely maintained their earnings forecasts over the past 30 days, signaling continued confidence in Boeing’s long-term trajectory.

Industry Comparison

Several of Boeing’s competitors in the aerospace and defense industry have already reported Q1 earnings, offering insight into market conditions:

- AAR Corp: Reported 19.5% revenue growth, but missed analyst estimates by 2.8%. AAR shares dropped 16.3%.

- Hexcel: Saw a 3.3% decline in revenue and missed projections by 3.4%.

Ongoing Challenges

Boeing ended its last fiscal year with poor performance due to ongoing safety and quality issues. The stock is currently trading below its 52-week average.

Nevertheless, Boeing still holds a strong position in the commercial aircraft market with a healthy order backlog.

The Q1 2025 report is expected to show a larger loss of $1.28 per share, compared to the first quarter of 2024. Revenue is estimated to increase by approximately 20% to $19.87 billion.

However, headwinds remain:

- China’s government halted Boeing aircraft deliveries,

- Geopolitical tensions,

- Safety concerns over the 737 MAX,

- And potential impacts from U.S.-China trade tariffs continue to loom large.

EARNING PROJECTION PREDICTION

WHAT THE ANALYST STATED