Amid global economic uncertainty, gold has long been considered a safe haven asset, protecting investment value from market volatility. Recently, U.S. President Donald Trump’s plan to impose a 25% tariff on imported automobiles, pharmaceuticals, and semiconductors has added a new layer of uncertainty to international trade. This move is expected to trigger various market reactions, including a potential rise in gold prices.

25% Tariff on Key Sectors: Consequences for the Economy

The 25% tariff targeting key industries such as automotive, pharmaceuticals, and semiconductors is intended to encourage companies to shift production back to the United States. However, this policy may lead to higher production costs and selling prices, ultimately burdening consumers. Additionally, U.S. trading partners could respond with retaliatory tariffs, further escalating global trade tensions. This uncertainty often drives investors to seek safer assets, with gold being one of the most preferred choices.

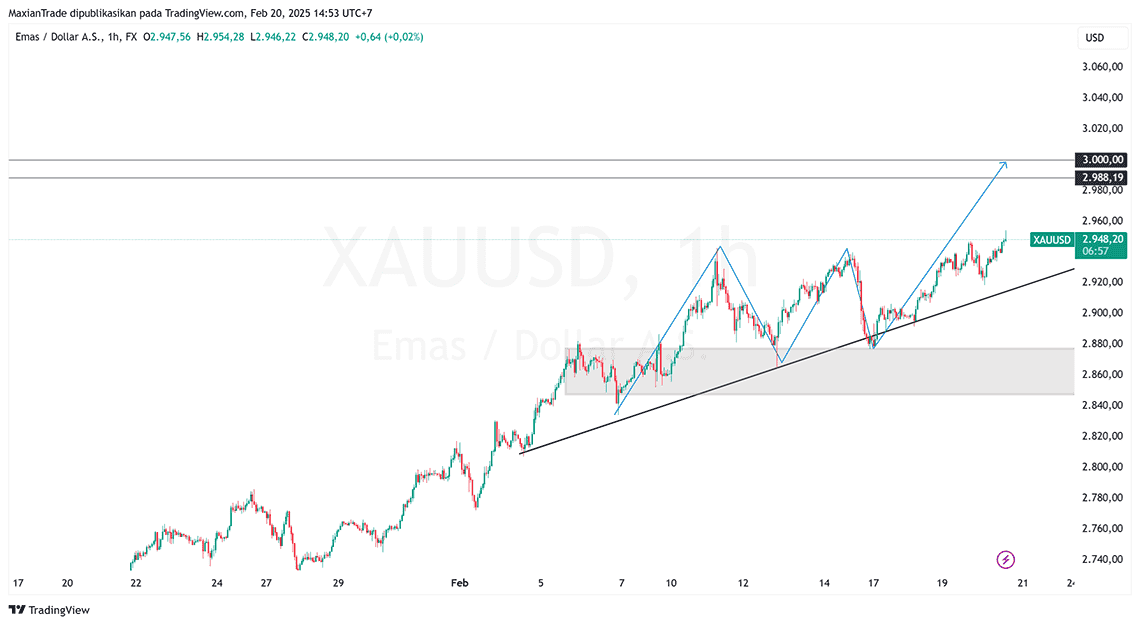

Gold Price Projection Toward the $3,000 Level

As economic uncertainty intensifies due to tariff policies and other geopolitical factors, gold prices have shown a significant upward trend. Some analysts predict that gold prices could reach the $3,000 per ounce mark in the near future. For instance, Goldman Sachs forecasts that gold prices will surpass $3,000 per ounce by the end of 2025, driven by strong central bank demand and investors seeking hedges against inflation and economic instability.

Gold Trading Strategies Amid Uncertainty

For traders, market volatility triggered by tariff policies and geopolitical tensions can present opportunities to generate profits. Here are some strategies to consider:

- Fundamental Analysis: Monitor developments in trade policies, central bank decisions, and global economic indicators to understand the factors influencing gold prices.

- Technical Analysis: Utilize technical tools and indicators to identify price trends, support and resistance levels, and gold price movement patterns.

- Risk Management: Set stop-loss limits and realistic profit targets to manage risks wisely.

- Portfolio Diversification: Avoid concentrating all capital in a single asset by spreading investments across various instruments to minimize risks.

In a dynamic and uncertain economic environment, gold remains an attractive investment option. However, it is crucial for traders and investors to stay informed and conduct thorough analysis before making investment decisions.