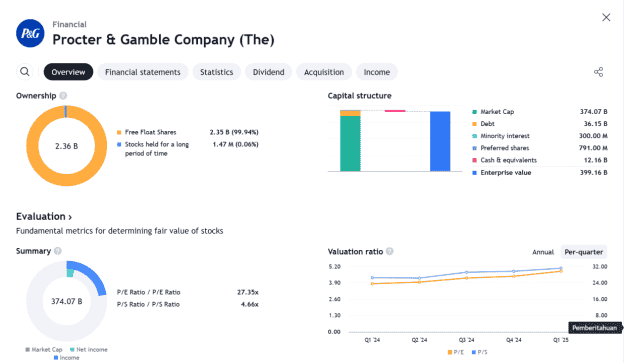

Procter & Gamble demonstrates a substantial market capitalization and robust capital structure with an enterprise value of $399.16 billion. Its high P/E ratio indicates a premium valuation, reflecting investor confidence in the company’s stability and growth potential. However, investors should consider this high valuation in the context of market risks and long-term growth expectations.

Stock Ownership:

- Free float shares: 2.36 billion (99.94% of total shares).

- Shares held for the long term: 1.47 million (0.06%).

Capital Structure:

- Market Capitalization: $374.07 billion.

- Debt: $36.15 billion.

- Minority Interest: $300 million.

- Preferred Shares: $791 million.

- Cash and Cash Equivalents: $11.3 billion.

- Enterprise Value: $399.16 billion.

Financial Performance Evaluation:

- P/E Ratio (Price to Earnings): 27.35x, indicating a premium valuation compared to net earnings.

- P/S Ratio (Price to Sales): 4.66x, reflecting a relatively high valuation compared to revenue.

Valuation Trends:

- The chart shows consistent growth in valuation ratios (P/E and P/S) annually and quarterly from Q2 2024 to Q3 2025. This suggests increasing market expectations for P&G’s performance growth.