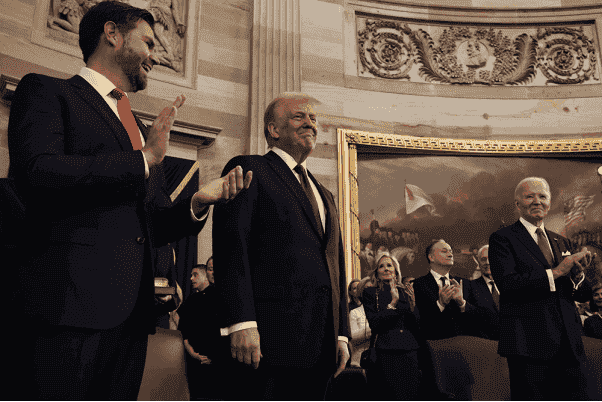

Donald Trump was inaugurated once again as the President of the United States on January 20, 2025. This event brings various impacts on global financial markets, creating both opportunities and challenges for investors. With policies that lean toward being pro-business and a focus on deregulation, various investment assets are poised to attract attention. Below is an analysis of opportunities in key asset classes:

1. Stock Market: Focus on Energy and Infrastructure Sectors

Trump is known for his support of the energy sector, including oil and gas. With potential policies easing environmental regulations, energy stocks such as ExxonMobil, Chevron, and ConocoPhillips could experience gains. Furthermore, plans for massive investments in infrastructure, including roads, bridges, and airports, may boost the stock performance of construction and materials companies like Caterpillar and Vulcan Materials.

However, investors should remain cautious of potential market volatility, particularly if there are significant shifts in international trade relations or geopolitical tensions.

2. Bonds: Prospects for Corporate Bonds

Expansive fiscal policies, such as tax cuts and infrastructure spending, may increase the government’s budget deficit. This often leads to higher yields on U.S. Treasury bonds, putting pressure on bond prices. However, high-quality corporate bonds could be an attractive option for investors seeking steady income with moderate risk.

3. Commodities: Oil, Gold, and Industrial Metals

- Crude Oil: With Trump likely supporting increased domestic oil production, oil prices may fluctuate. On one hand, increased supply could put downward pressure on prices. On the other hand, geopolitical tensions in the Middle East or policies limiting energy imports might drive prices higher.

- Gold: As a safe-haven asset, gold remains appealing to investors concerned about the uncertainties of Trump’s policies. Additionally, a potential weakening of the U.S. dollar due to budget deficits could serve as a positive catalyst for gold prices.

- Industrial Metals: The demand for raw materials for large-scale infrastructure projects may drive up the need for industrial metals like copper and aluminum.

4. Forex: Dynamics of the US Dollar

The foreign exchange market will be significantly influenced by Trump’s policies. If his administration pushes for a weaker US dollar to support exports, currencies like the euro, Japanese yen, and Chinese yuan could strengthen. However, the US dollar will likely retain its appeal as a global reserve currency, especially during times of uncertainty.

5. Cryptocurrency: An Alternative Amid Uncertainty

Unclear policies regarding the technology and financial sectors could boost interest in digital assets like Bitcoin and Ethereum. Cryptocurrencies may also serve as a hedge against political and economic uncertainties.

Investor Strategies

To capitalize on these opportunities, investors should:

- Diversify portfolios: Combine stocks, bonds, and commodities to minimize risk.

- Monitor policy developments: Keep track of changes in fiscal, monetary, and trade policies.

- Use hedging strategies: Employ derivatives or gold to protect portfolios from market volatility.

Trump’s inauguration presents various investment opportunities but also carries risks that must be anticipated. With careful analysis and the right strategies, investors can leverage market dynamics to achieve optimal outcomes.

Written by Adam Ibrahim Aji

WPB Maxco Futures