Review:

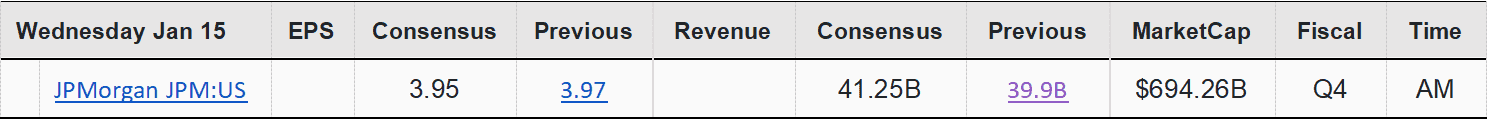

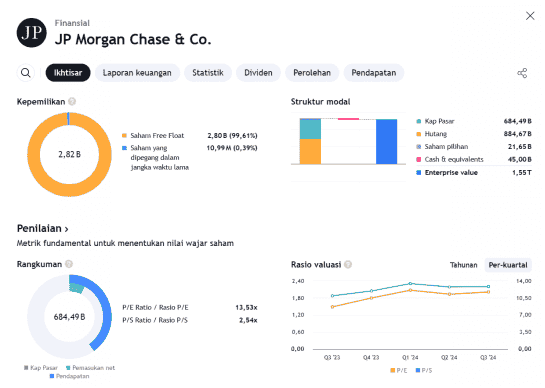

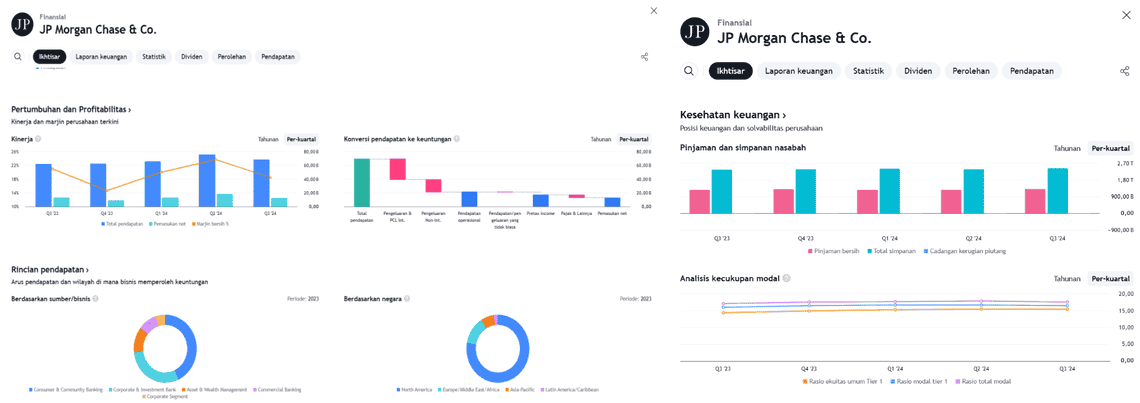

JPMorgan (JPM) is set to release its Q4 2024 earnings report on January 15, with an estimated revenue of $40.92 billion, reflecting a 6.1% YoY growth. Despite operational challenges, JPMorgan is expected to deliver solid performance, though a slight decline in profit may occur due to increased credit loss provisions and higher operating costs.

Key Factors Influencing Q4 Performance:

- Net Interest Income (NII): Projected to decrease by 4.9% YoY, supported by Federal Reserve rate cuts.

- Investment Banking (IB): M&A activities could boost IB revenue by 43.1% YoY.

- Market Revenue: Expected 15% growth due to robust client activity and market volatility.

- Mortgage Banking Revenue: Anticipated 50% YoY surge despite high interest rates.

- Expenses: Operational costs are likely to rise due to branch expansions and technology investments.

JPMorgan’s 2024 guidance includes $92.5 billion in NII and $91.5 billion in adjusted noninterest expenses, with $17 billion allocated to technology and expectations for moderate loan growth and flat deposits.