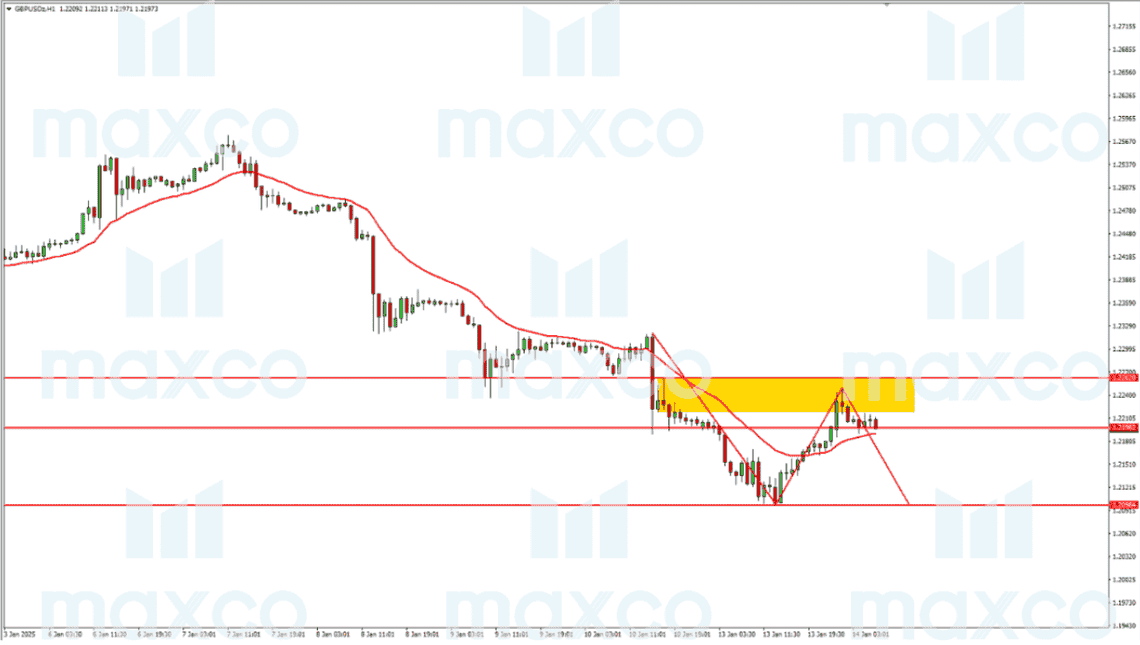

GBPUSD currently shows potential for a downward movement on the H4 time frame. This is due to its inability to break through the supply area, which has capped further price increases. Additionally, the price is held at the key Fibonacci 61.8% level, signaling a potential continuation of a bearish trend.

Technically, this decline could push the price back to the previous support area, providing traders with opportunities to anticipate the bearish continuation. Monitoring these levels is crucial for strategizing trades effectively.

Trade Recommendation

Entry Sell : 1.21982

Stop Loss : 1.22620

Take Profit (1) : 1.20984

Take Profit (2) : 1.21000

Conclusion:

GBPUSD is at a critical juncture, with the potential for further weakening due to supply and Fibonacci resistance. Traders should remain vigilant and consider both technical and fundamental factors influencing the market direction.

*DISCLAIMER: All content in daily forex news is informative. PT. Maxco Futures does not guarantee its accuracy and completeness. The company is not responsible for investment losses due to the use of the information contained.