Review

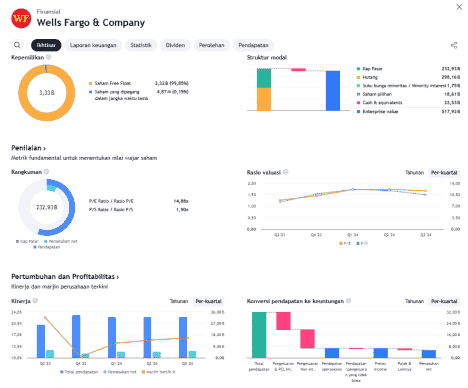

Wells Fargo is a leading financial services company in the U.S. with approximately $1.9 trillion in total assets. It offers a range of banking, investment, mortgage, and financial products across all 50 U.S. states. The company operates in four main segments:

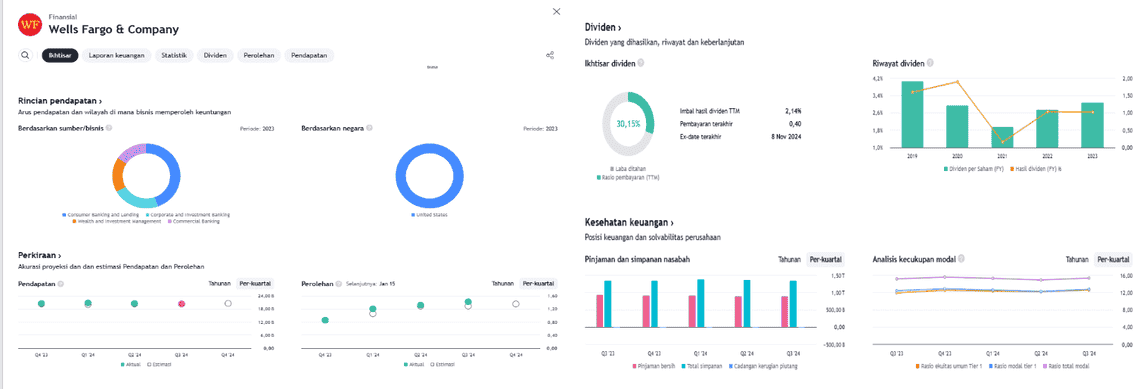

- Consumer Banking and Lending

- Commercial Banking

- Corporate and Investment Banking

- Wealth and Investment Management

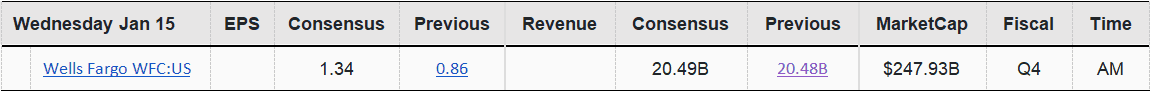

Wells Fargo is a major U.S. bank, consistently outperforming EPS and revenue estimates over the past six quarters.

Performance Drivers:

- Credit Card Portfolio: Business expansion with 13 consecutive quarters of growth, supported by products like the One Key Card with Expedia.

- Capital and Liquidity Position: Strong financial stability with a Common Equity Tier 1 ratio of 11.3% and a liquidity coverage ratio of 127%.

- Operational Efficiency: Reduced workforce by 20% since 2020 and leveraged technology to lower costs.

- Strategic Partnerships: Collaboration with Volkswagen to provide auto financing by 2025.

Risks:

- Commercial Real Estate Market: High office vacancy rates due to remote work may elevate default risks in the commercial real estate loan portfolio.

- Economic Volatility: Interest rate fluctuations and global market uncertainties (e.g., Germany and China) could pressure income from loans and investments.

Outlook and Valuation:

Wells Fargo is expected to grow further, especially if the Federal Reserve lifts asset restrictions in 2025, enhancing the bank’s capacity to expand. Its valuation, with a P/B ratio of 1.46x and P/E ratio of 13.60x, is considered reasonable compared to other major banks.

Overall, Wells Fargo holds a positive outlook, though risks from commercial real estate and global economic volatility require attention.