Maxco.co.id – Ever heard of XAUUSD? Know the potential but don’t know how to analyze XAUUSD? For those unfamiliar, XAUUSD is the symbol for the currency pair of Gold (XAU) against the US Dollar (USD).

XAU is the symbol for precious metal commodities, where “AU” is derived from “aurum,” meaning gold. The letter X indicates it’s a commodity. As for USD, you might have guessed it – it’s the symbol for the US Dollar.

In simple terms, XAUUSD represents the price quote for gold in USD. Or usually lay people call it trading gold.

Recently, more people are realizing that trading XAUUSD can be a gateway to lucrative profits. But of course, it requires solid understanding. This article will guide you, beginner traders, to master XAUUSD analysis, combining technical and fundamental analysis in an easy-to-understand way. Get ready to seize the opportunity!

Why Should You Try Trading Gold?

Before we dive into analysis techniques, let’s discuss why XAUUSD is an attractive choice.

Gold, known as a safe haven asset, is often sought by investors during times of market uncertainty. This means XAUUSD price movements are often influenced by global market sentiment, whether it’s due to macroeconomic news or political turmoil.

The price fluctuations are quite significant, offering high profit potential. For instance, the daily average price range can reach up to 5000 pips, which is equivalent to around $5000 per day.

But remember, higher profit potential also means higher risk. Remember: high risk, high reward!

Technical Analysis of XAUUSD: Reading Price Charts

Technical analysis focuses on price history and trading volume to predict future price movements. We can use several commonly used indicators and chart patterns.

Don’t worry; we’ll go over each one step-by-step.

1. Moving Average (MA) Indicator: Determining Trends

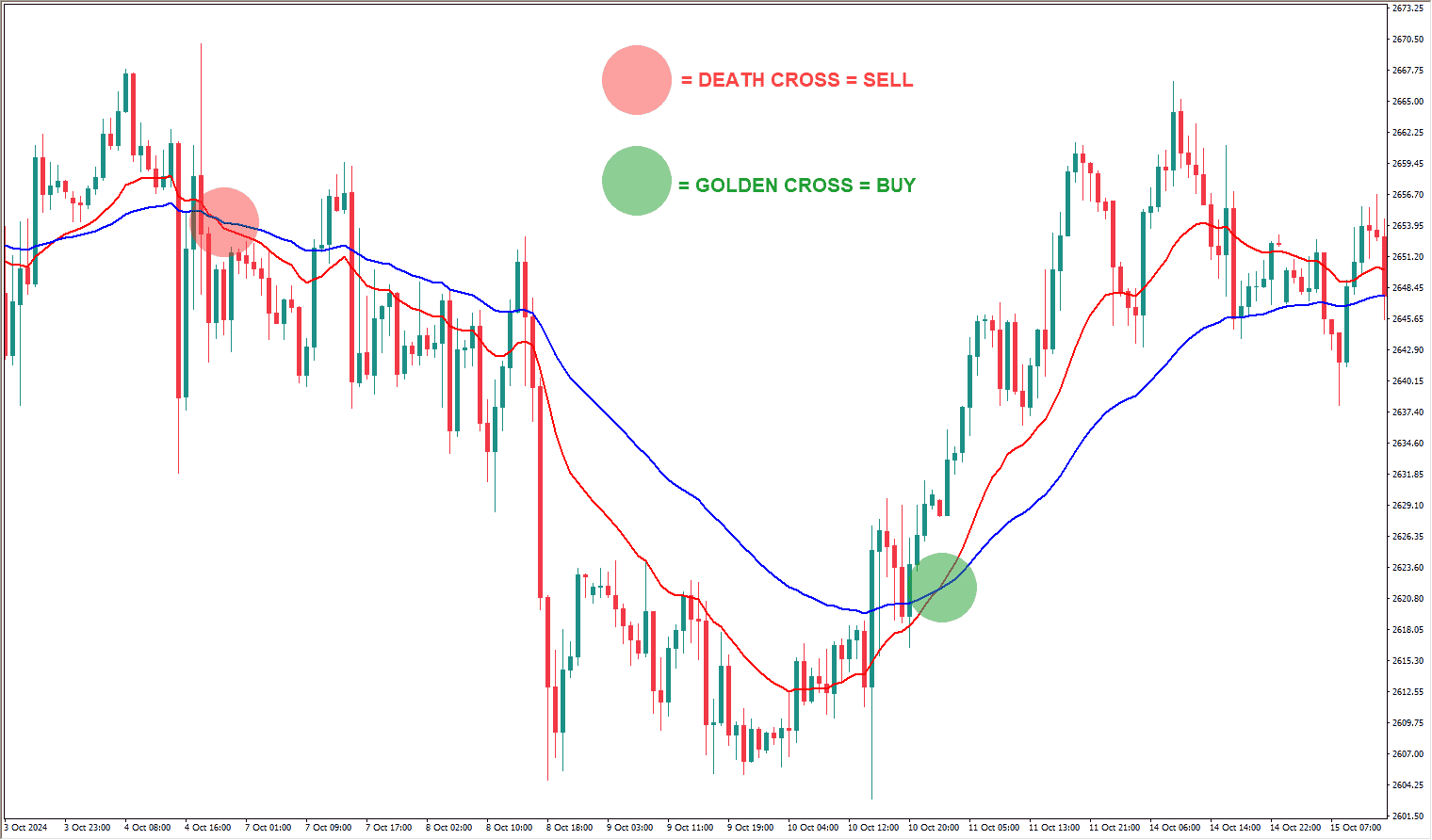

MA represents the average price over a specified period. Commonly used MAs are the 20, 50, and 200-day MAs. The crossover between MAs can signal buy or sell signals.

-

- Golden Cross: When a short-term MA (e.g., MA 20) crosses above a long-term MA (e.g., MA 50), it’s often seen as a bullish signal (price is expected to rise).

-

- Death Cross: When a short-term MA crosses below a long-term MA, it’s often seen as a bearish signal (price is expected to fall).

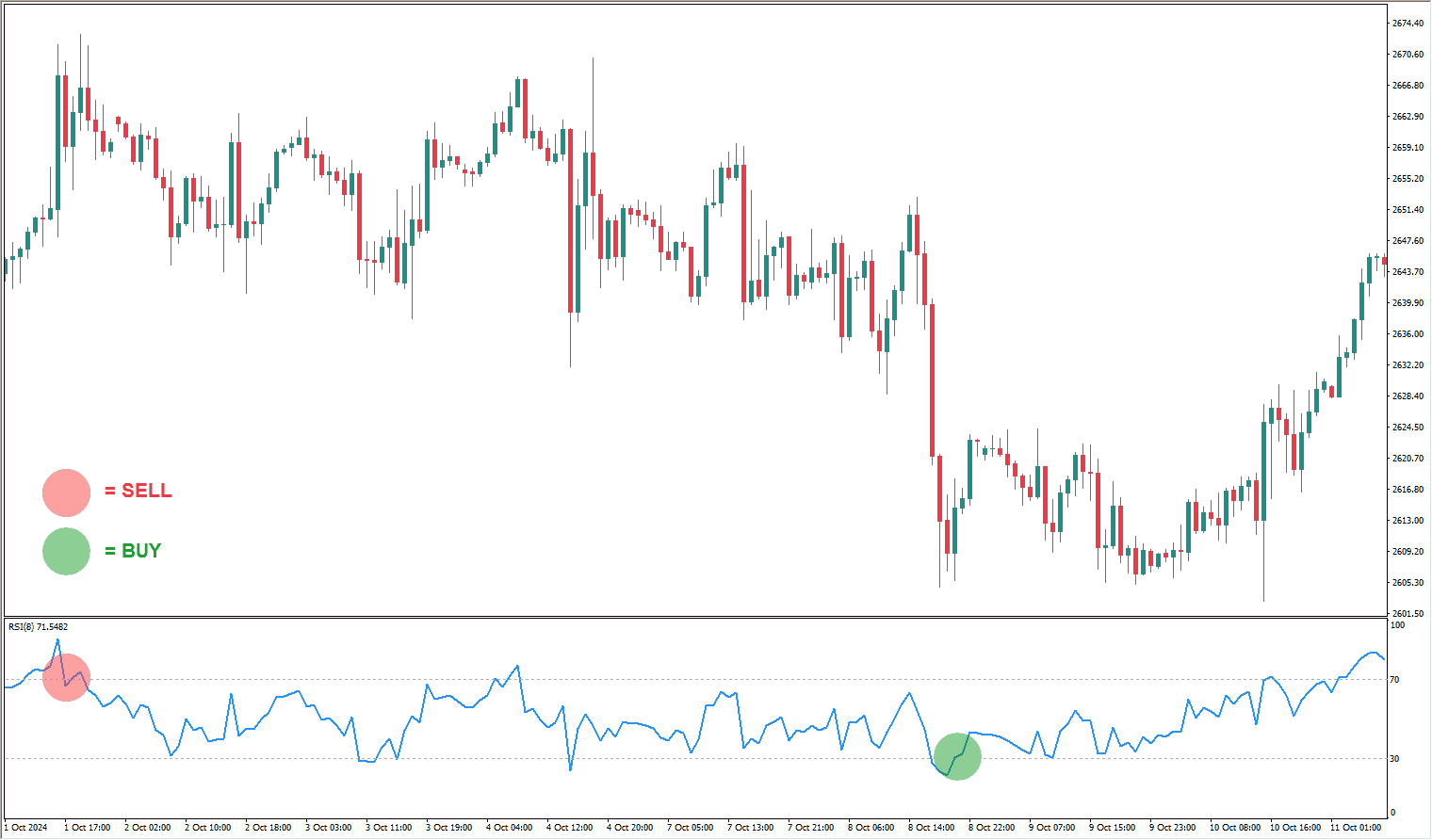

RSI measures the strength of a trend and helps identify overbought and oversold conditions. RSI values between 0-30 indicate oversold conditions, while RSI values between 70-100 indicate overbought conditions. These levels can signal potential trend reversals.

-

- Apply Risk Management Properly

Never take on too high a risk. Set a risk limit at the start of each transaction, ensuring that potential losses do not exceed that limit. Implement risk management techniques, such as using stop-losses to cap losses.

- Apply Risk Management Properly

-

- Keep Learning Continuously

Markets are dynamic and always changing. Keep learning and updating your knowledge, as what you know today may not be applicable in the future.

- Keep Learning Continuously

-

- Be Patient and Disciplined

- This may sound classic, but the fact is, most traders who cannot manage their psychology end up failing. Trading requires patience and discipline. Avoid making impulsive decisions and stick to your trading plan. Avoid making trading decisions based on emotions like FOMO or greed.

Summary

Mastering XAUUSD analysis requires time, practice, and consistency. By combining technical and fundamental analysis and applying proper risk management, you can increase your chances of success in XAUUSD trading.

Remember that trading always carries risks, so make sure to keep learning and stay cautious. Good luck and happy trading!

3. Candlestick Chart Patterns: Identifying Price Patterns

Candlestick patterns visually indicate price movements. Some commonly used patterns include:

-

- Hammer & Hanging Man: Indicate potential bullish (hammer) or bearish (hanging man) reversals.

-

- Doji: Shows market uncertainty and potential trend reversal.

-

- Engulfing Pattern: Indicates a strong potential trend reversal.

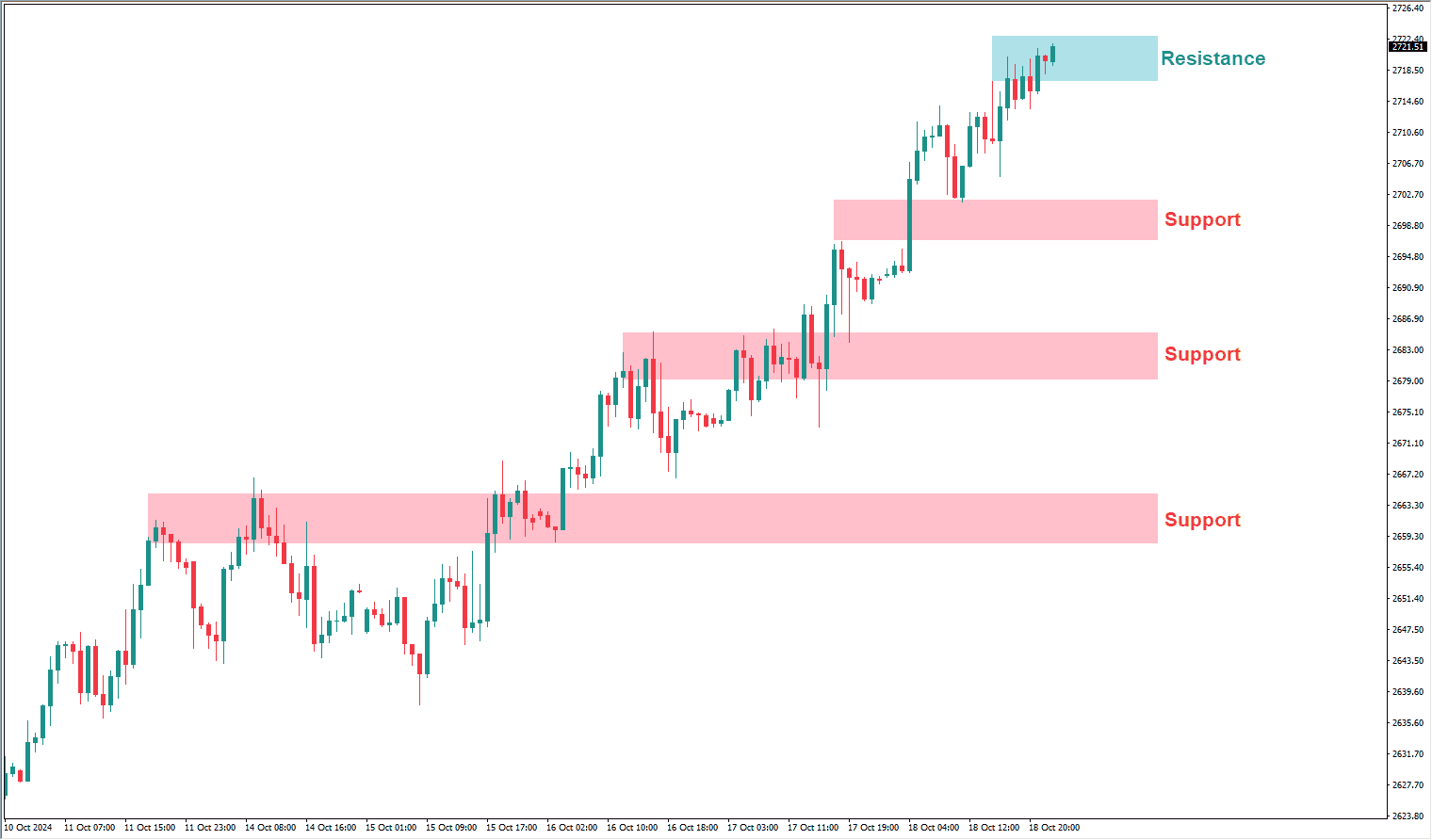

4. Support and Resistance: Price Defense Levels

Support is a price level where prices tend to have difficulty falling further. Resistance is a price level where prices tend to have difficulty rising higher. Breaking through support or resistance levels can provide strong signals.

Fundamental Analysis of XAUUSD: Understanding External Market Factors

Fundamental analysis focuses on economic and geopolitical factors that impact gold prices. Here are some key factors:

-

- US Federal Reserve (The Fed) Monetary Policy: A Fed rate hike generally pressures gold prices by increasing the attractiveness of the US Dollar. Conversely, a rate cut tends to boost gold prices.

- Inflation: High inflation tends to drive investors toward safe-haven assets like gold, leading to higher gold prices.

- Global Economic Growth: Strong global economic growth generally pressures gold prices as investors lean towards higher-risk assets.

- Geopolitics: Global political instability, wars, or terrorism threats tend to drive investors to safe assets like gold, causing gold prices to rise.

- Market Sentiment: Investor sentiment toward the US Dollar and the global economy overall also affects gold prices.

- Physical Gold Demand: Demand for gold in jewelry, industry, investments, and government reserves can also influence gold prices. Governments often purchase gold for foreign reserves via central banks.

How to Combine Technical and Fundamental Analysis?

Success in trading XAUUSD requires a combination of technical and fundamental analysis. Technical analysis provides short-term trading signals, while fundamental analysis provides a broader view of long-term price movements. Ideally, both should align to increase prediction accuracy.

For example, you spot a bullish candlestick pattern and RSI in an oversold condition, indicating a bullish technical signal. However, if you read that the Fed is planning to raise rates, this represents a bearish fundamental signal. You need to weigh both signals before making a trading decision.

Tips for Beginner XAUUSD Trader

-

- Start with a Demo Account

It’s recommended to practice trading with a demo account before using real money. With a demo account, you can simulate trading strategies and techniques without risking financial loss, as the transactions involve virtual money. Although it’s virtual, the demo account still uses real market prices, so you can experience price movements based on actual market conditions.

- Start with a Demo Account

-

- Apply Risk Management Properly

Never take on too high a risk. Set a risk limit at the start of each transaction, ensuring that potential losses do not exceed that limit. Implement risk management techniques, such as using stop-losses to cap losses.

- Apply Risk Management Properly

-

- Keep Learning Continuously

Markets are dynamic and always changing. Keep learning and updating your knowledge, as what you know today may not be applicable in the future.

- Keep Learning Continuously

-

- Be Patient and Disciplined

- This may sound classic, but the fact is, most traders who cannot manage their psychology end up failing. Trading requires patience and discipline. Avoid making impulsive decisions and stick to your trading plan. Avoid making trading decisions based on emotions like FOMO or greed.

Summary

Mastering XAUUSD analysis requires time, practice, and consistency. By combining technical and fundamental analysis and applying proper risk management, you can increase your chances of success in XAUUSD trading.

Remember that trading always carries risks, so make sure to keep learning and stay cautious. Good luck and happy trading!